38 government zero coupon bonds

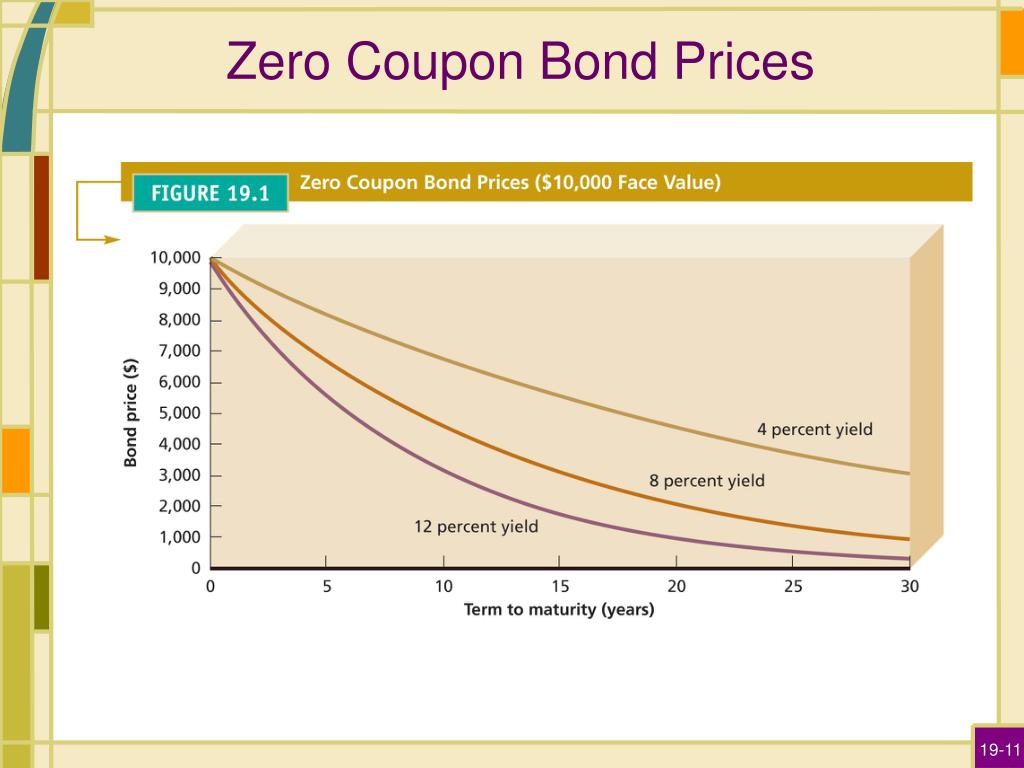

Government - Continued Treasury Zero Coupon Spot Rates* 3.38. 3.79. *Four quarters covering calendar year 2012 and the first and second quarters of calendar year 2013 prepared by Economic Policy (EP) using the Office of the Comptroller of the Currency (OCC) legacy model. Legacy model quarterly rates can be viewed within the "Selected Asset and Liability Price Report" under "Spot (Zero Coupon) Rates" on ... Zero Coupon Bond (Definition, Formula, Examples, Calculations) Zero-Coupon Bond (Also known as Pure Discount Bond or Accrual Bond) refers to those bonds which are issued at a discount to its par value and makes no periodic interest payment, unlike a normal coupon-bearing bond. In other words, its annual implied interest payment is included in its face value which is paid at the maturity of such bond.

Advantages and Risks of Zero Coupon Treasury Bonds Zero-coupon government bonds can be purchased directly from the Treasury at the time they are issued. After the initial offering, they can be purchased on the open market through a brokerage...

Government zero coupon bonds

Yield Curves for Zero-Coupon Bonds - Bank of Canada These files contain daily yields curves for zero-coupon bonds, generated using pricing data for Government of Canada bonds and treasury bills. Each row is a single zero-coupon yield curve, with terms to maturity ranging from 0.25 years (column 1) to 30.00 years (column 120). The data are expressed as decimals (e.g. 0.0500 = 5.00% yield). What are Zero Coupon Bonds? - Civilsdaily Zero-Coupon Bonds These are non-interest bearing, non-transferable special GOI securities that have a maturity of 10-15 years and are issued specifically to Punjab & Sind Bank. Germany sells a zero-percent 30-year bond for the first time A zero-coupon bond from the German government is an option for investors to park their money in a longer term safe-haven asset and lock their cash for a 30-year period amid global uncertainties....

Government zero coupon bonds. Zero Coupon Bond | Investor.gov Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. The maturity dates on zero coupon bonds are usually long-term—many don't mature for ten, fifteen, or more years. Russian Government Bond Zero Coupon Yield Curve, Values (% per annum ... Russian Government Bond Zero Coupon Yield Curve, Values (% per annum) 24.05.2022 - 31.05.2022. Su. Domestic bonds: Greece, Bills 0% 9jun2023, EUR (364D) GR0004128543 Issue Information Domestic bonds Greece, Bills 0% 9jun2023, EUR (364D). Issue, Issuer, Yield, Prices, Payments, Analytical Comments, Ratings ... Also there are 21 government bonds with the maturity up to 30 years. The level of Central Government Debt as of 31.03.2013, is equal to €309.3 billion. The volume of Government Bonds is equal to € ... Zero-Coupon Bond Definition - Investopedia A zero-coupon bond, also known as an accrual bond, is a debt security that does not pay interest but instead trades at a deep discount, rendering a profit at maturity, when the bond is redeemed for...

What are zero coupon bonds? - The Indian Express "It is a great innovation by the government where it is using Rs 100 to create an impact of Rs 200 in the economy. It is issuing a zero coupon bond aggregating to Rs 5,500 crore at par to Punjab & Sind Bank that will mature in tranches between 2030 to 2035. The market value of this bonds would be around Rs 2,750 crore. Statistical Tables | RBA Capital Market Yields - Government Bonds - Monthly - F2.1. Data. Aggregate Measures of Australian Corporate Bond Spreads and Yields - F3. ... Zero-coupon Interest Rates - Analytical Series - 2009 to Current - F17 . F17 - Discount Factors; F17 - Forward Rates; F17 - Yields; United States - Zero-coupon yield bond - USA 10-year Zero coupon Yield ... United States - Zero-coupon yield bond - USA 10-year Zero coupon Yield Curve - Yield, end of period - US dollar, provided by Reuters (Financial market data) Period ↓: value: obs. status: 2022-Q1: 2.4437: Normal value (A) 2021-Q4 : 2021-Q3: 1.5345: Normal value (A) 2021-Q2: 1.4701: Normal value (A) 2021-Q1: 1.8297: Normal value (A) 2020-Q4: 0.9385: Normal value (A) 2020-Q3: 0.7179 What are Zero coupon bonds? - INSIGHTSIAS What are Zero coupon bonds? Context: The government has used financial innovation to recapitalise Punjab & Sind Bank by issuing the lender Rs 5,500-crore worth of non-interest bearing bonds valued at par. These are special types of zero coupon bonds issued by the government after proper due diligence and these are issued at par.

Treasury Coupon Issues | U.S. Department of the Treasury The Yield Curve for Treasury Nominal Coupon Issues (TNC yield curve) is derived from Treasury nominal notes and bonds. The Yield Curve for Treasury Real Coupon Issues (TRC yield curve) is derived from Treasury Inflation-Protected Securities (TIPS). The Treasury Breakeven Inflation Curve (TBI curve) is derived from the TNC and TRC yield curves ... Further details about yields data | Bank of England Zero coupon real curves. Calculated from the prices of index-linked gilts, which were first issued following the 1981 budget, and comprised approximately 25% of the UK Government bond market at end-March 2001. Domestic bonds: The Nimo's, 0% 27oct2022, EUR (272D) ES0505555070 Issue Information Domestic bonds The Nimo's, 0% 27oct2022, EUR (272D). Issue, Issuer, Yield, Prices, Payments, Analytical Comments, Ratings How to Invest in Zero-Coupon Bonds | Bonds | US News Zero-coupon bonds live in the investing weeds, easily ignored by ordinary investors seeking growth for college and retirement. Even fixed-income investors may pass them by, because they don't...

Yield from Government 10 bonds UK 2022 | Statista The monthly average yield on 10 year nominal zero coupon British Government Securities in the United Kingdom (UK) has seen a continued decrease between December 2019 and July 2020, before...

Germany Government Bonds - Yields Curve The Germany 10Y Government Bond has a 1.501% yield. 10 Years vs 2 Years bond spread is 53.1 bp. Normal Convexity in Long-Term vs Short-Term Maturities. Central Bank Rate is 0.00% (last modification in March 2016). The Germany credit rating is AAA, according to Standard & Poor's agency.

Zero-coupon bond - Wikipedia A zero coupon bond is a bond in which the face value is repaid at the time of maturity. That definition assumes a positive time value of money. It does not make periodic interest payments or have so-called coupons, hence the term zero coupon bond. When the bond reaches maturity, its investor receives its par value. Examples of zero-coupon bonds include US Treasury bills, US savings bonds, long-term zero-coupon bonds, and any type of coupon bond that has been stripped of its coupons. Zero coupon

United Kingdom Government Bonds - Yields Curve The United Kingdom 10Y Government Bond has a 2.205% yield. 10 Years vs 2 Years bond spread is 45.8 bp. Normal Convexity in Long-Term vs Short-Term Maturities. Central Bank Rate is 1.00% (last modification in May 2022). The United Kingdom credit rating is AA, according to Standard & Poor's agency.

Government, Zero-Coupon & Floating-Rate Bonds - Study.com Bonds are debts that investors can buy to be repaid at a designated interest rate. Explore examples of three different types of bonds commonly exchanged: Government, Municipal, zero-coupon, and ...

Govt's capital infusion via zero coupon bonds positive for PSU banks With the zero coupon bonds, the banks will not benefit from that income. Since FY18, the government has used recapitalisation bonds with banks subscribing to them with a maturity ranging between 10 and 15 years, and coupon rates of 7.4 per cent-7.7 per cent. The government would then use the funds raised to be infused back in PSBs as equity.

Zero-Coupon Bond - Definition, How It Works, Formula A zero-coupon bond is a bond that pays no interest and trades at a discount to its face value. It is also called a pure discount bond or deep discount bond. U.S. Treasury bills are an example of a zero-coupon bond.

Zero Coupon Yield Curve - The Thai Bond Market Association 50.158904. Remark: 1. The above yields are based upon average bids quoted by primary dealers, after 15% data cut-off from top and bottom when ranked by value. 2. Average bidding yields of 1-month, 3-month, 6-month and 1-year T-bills are bond equivalent yield converted from average simple yields. 3.

zero coupon government bonds News and Updates from The Economic Times ... zero coupon government bonds News and Updates from The Economictimes.com. zero coupon government bonds News and Updates from The Economictimes.com. Benchmarks . Nifty-142.5. NSE Gainer-Large Cap . Shriram Trans Fin 60.25.

Germany sells a zero-percent 30-year bond for the first time A zero-coupon bond from the German government is an option for investors to park their money in a longer term safe-haven asset and lock their cash for a 30-year period amid global uncertainties....

What are Zero Coupon Bonds? - Civilsdaily Zero-Coupon Bonds These are non-interest bearing, non-transferable special GOI securities that have a maturity of 10-15 years and are issued specifically to Punjab & Sind Bank.

Yield Curves for Zero-Coupon Bonds - Bank of Canada These files contain daily yields curves for zero-coupon bonds, generated using pricing data for Government of Canada bonds and treasury bills. Each row is a single zero-coupon yield curve, with terms to maturity ranging from 0.25 years (column 1) to 30.00 years (column 120). The data are expressed as decimals (e.g. 0.0500 = 5.00% yield).

Post a Comment for "38 government zero coupon bonds"