42 zero coupon bonds risk

Solved The current zero-coupon yield curve for risk-free - Chegg What is the price per $ 100 face value of a four-year, zero-coupon, risk-free bond? The price per $ 100 face value of the four-year, zero-coupon, risk-free bond is $____. (Round to the nearest cent.) Expert Answer. Who are the experts? Experts are tested by Chegg as specialists in their subject area. We review their content and use your ... Assessing Risk - Investing In Bonds Market Risk As with all fixed-income securities, the yields or interest rates on zero coupon municipal bonds fluctuate, usually in step with general market rates. While the interest on a bond is fixed by the price you paid, newer bond issues may be offered at higher or lower rates depending on prevailing interest rates when they are issued.

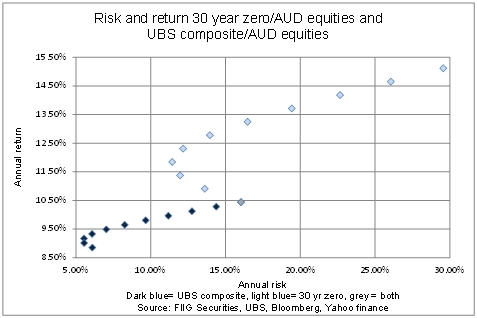

The One-Minute Guide to Zero Coupon Bonds | FINRA.org Like virtually all bonds, zero-coupon bonds are subject to interest-rate risk if you sell before maturity. If interest rates rise, the value of your zero-coupon bond on the secondary market will likely fall. Long-term zeros can be particularly sensitive to changes in interest rates, exposing them to what is known as duration risk.

Zero coupon bonds risk

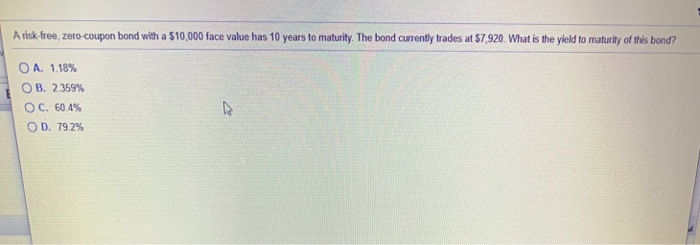

Advantages and Risks of Zero Coupon Treasury Bonds Jan 31, 2022 · Unique Risks of Zero-Coupon U.S. Treasury Bonds Because of their sensitivity to interest rates, zero-coupon Treasury bonds have incredibly high interest rate risk. Treasury zeros fall significantly... 6.2.1 Flashcards | Quizlet A risk-free, zero-coupon bond with a face value of $10,000 has 15 years to maturity. If the YTM is 6.1%, which of the following would be closest to the price this bond will trade at? A) $4937 B) $5760 C) $6582 D) $4114 D) Price = (Face value) / (1 + YTM)N. Price = ($10,000 ) / (1 + 6.1%)15 = $4114 What Is a Zero-Coupon Bond? | The Motley Fool With zero-coupon bonds, interest rate risk is at its highest since zeros display unusual sensitivity to changes in interest rates -- although the underlying inverse relationship to interest rates...

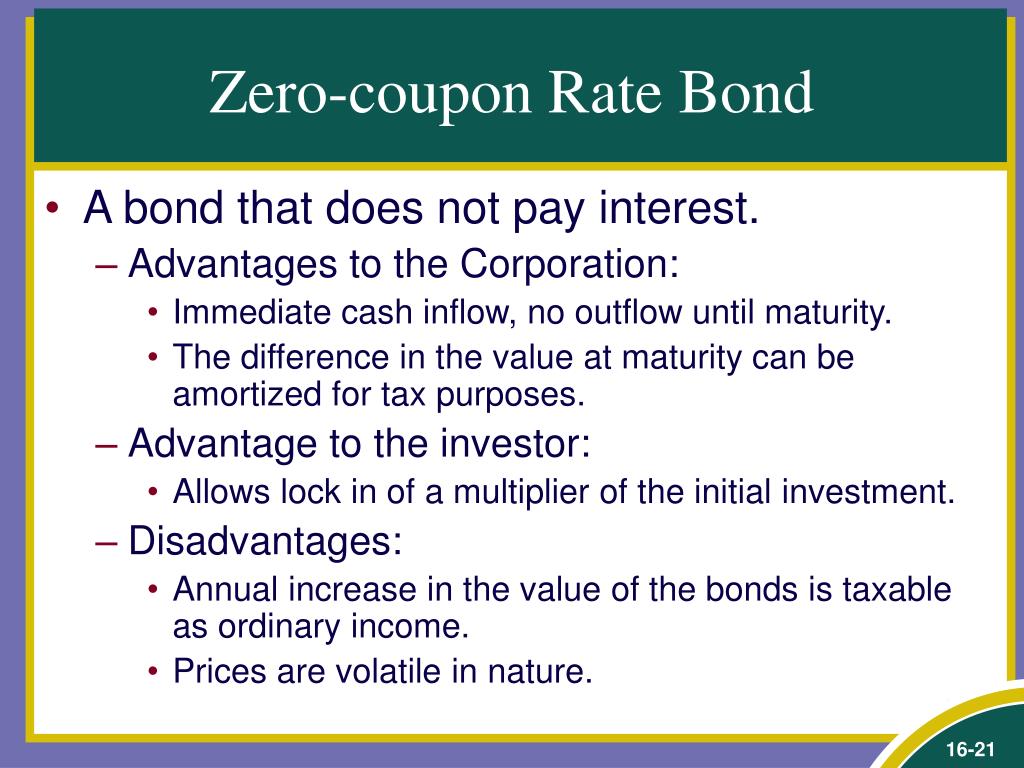

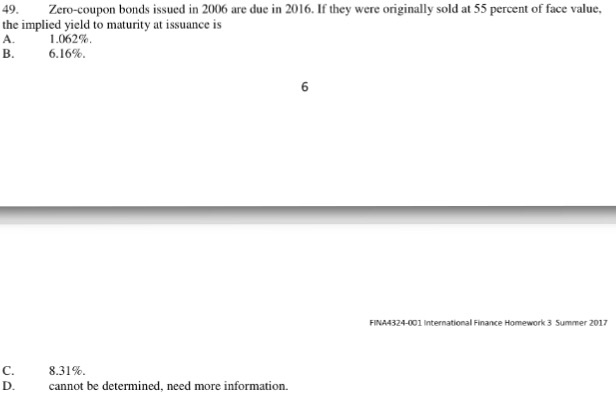

Zero coupon bonds risk. Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... There are two major disadvantages of zero-coupon bonds. The first disadvantage is they do not throw off any income as the capital is stored in the bond. In some countries the imputed interest may be taxed as income even though the bond has not yet been redeemed or reached maturity. Zero Coupon Bond Definition and Example | Investing Answers What are the Risks of a Zero Coupon Bond? If you sell a zero coupon bond before the maturity date, you could face interest rate risk. Meaning, your investment may go down in value if interest rates go up. The longer the maturity date, the more risk you'll face. What Are Zero Coupon Bonds And Their Risks- Tavaga | Tavagapedia Zero-Coupon Bonds can render great returns if used strategically for your investment goal. In absence of any exceptional case, like intermittent coupon payments, Zero- Coupon Bond's yield to maturity is calculated as: Yield = (FV/PV) 1/n - 1 Where, FV = Face value PV = Present Value n = number of periods Example Zero-Coupon Bonds: Pros and Cons - Management Study Guide Higher Yields: Firstly, zero-coupon bonds are perceived as higher-risk bonds. This is because investors pay money upfront and then do not have much control over it. Also, since the money is locked in over longer periods of time, the perceived risk is more.

Solved | Chegg.com Zero-coupon bonds do NOT have which type of risk for investors? Group of answer choices b) Interest Rate Risk c) Credit Risk e) Systematic Risk a) Reinvestment Risk d) Unsystematic Risk Expert Answer Option (a) is Correct Reinvestment Risk Reason : Zero-coupon bonds … View the full answer Previous question Next question Zero Coupon Bond (Definition, Formula, Examples, Calculations) Zero-Coupon Bond (Also known as Pure Discount Bond or Accrual Bond) refers to those bonds which are issued at a discount to its par value and makes no periodic interest payment, unlike a normal coupon-bearing bond. In other words, its annual implied interest payment is included in its face value which is paid at the maturity of such bond. Zero Coupon Muni Bonds - What You Need to Know The problem with traditional bonds is that investors must reinvest the semiannual interest payments at potentially lower interest rates. Since investors can lock in a specific rate of return with zero coupon bonds, they are spared from worrying about reinvesting the capital at a later date and thereby avoid any reinvestment risks. Zero Coupon Bonds Risk Zero Coupon Bonds Risk . Zero Coupon Bonds Risk, Zizzi Deals London, Mpix Black Friday Deals, Online Coupons For Baby Shower Stuff, Hollister Coupon Black Friday 2020, Sears Coupons In Store Dec 2020, Shutterfly Prints Coupon Code 2019 ...

Do zero-coupon bonds have interest rate risk? - Quora Which is considered to be risky a 10-year coupon bond or a 10-year zero coupon bond? It depends on what you mean by risk. The price of the zero is likely to be more volatile, but the total return you will earn if you hold it to maturity is known with 100% certainty. So there is interim price volatility, but no risk at all if you hold to maturity. Risk-Neutral Pricing Formula for Zero-coupon bonds with Default Risk ... 1 Answer Sorted by: 1 A brief educational note and then where you can find the info... As a first step, set the expected payoff equal to 0 where prob_D = probability of default, cur_Px = current price, mat_Px = maturity payment, and R = recovery. Therefore prob_D * (recovery - cur_Px) + (1 - prob_D) * (mat_Px - cur_Px) = 0 results in The Pros and Cons of Zero-Coupon Bonds - Financial Web Zero-coupon bonds are a type of bond that does not pay any regular interest payments to the investor. Instead, you purchase the bond for a discount and then when it matures, you can get back the face value of the bond. ... Another problem with zero coupon bonds is that they have a higher default risk than traditional bonds. The reason behind ... The Allure Of Zero Coupon Municipal Bonds: A Low Risk Investment With ... The La Mesa bond is a zero coupon bond that pays no coupon i.e. no income each year. In exchange, you can buy one La Mesa bond for only $73.573, a $26.427 discount to par value. When it matures on 8/1/2026, you get $100 for each share you buy, which comes out to a yield to maturity of 3.2%.

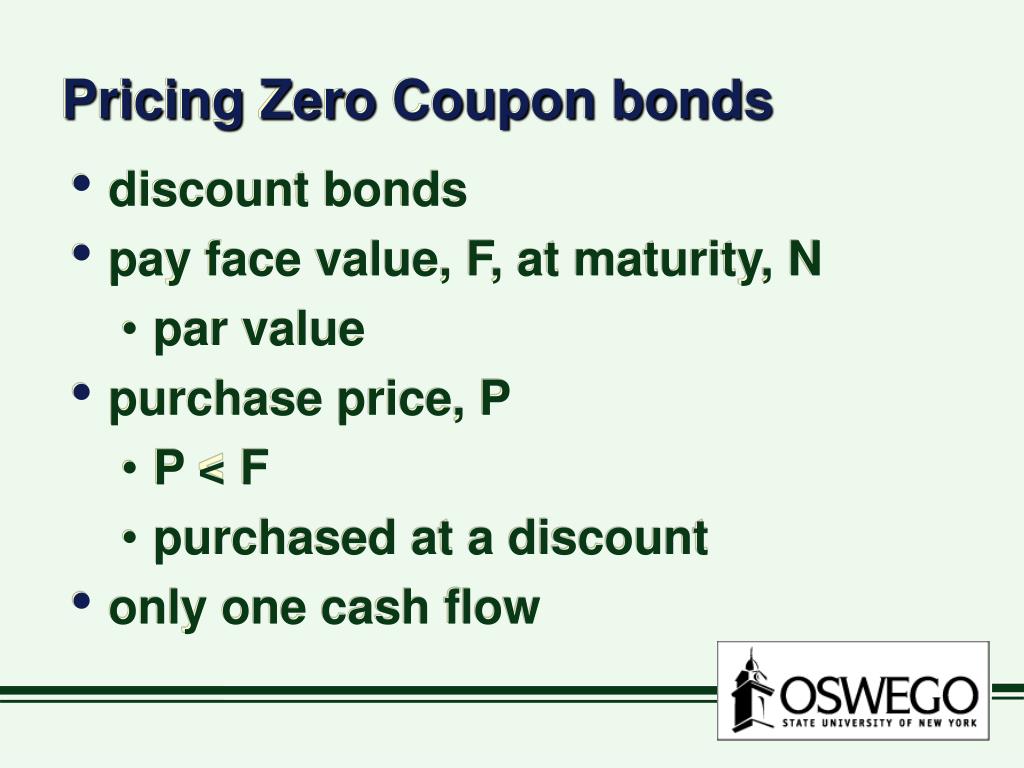

Zero-Coupon Bond Definition - Investopedia A zero-coupon bond, also known as an accrual bond, is a debt security that does not pay interest but instead trades at a deep discount, rendering a profit at maturity, when the bond is redeemed for its full face value.

Zero Coupon Bond: study guides and answers on Quizlet Interest Rate Risk Foreign Exchange Risk Zero Coupon Bonds Zero Coupon Bond Long Term Bonds TERMS IN THIS SET (13) If a bond investor receives all the coupon payments on time and the face value on the contract maturity date, investor's return could still vary because of _____ risk. A. price B. liquidity C. reinvestment D. unsystematic E. credit

Zero-coupon bond - Wikipedia A zero coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. That definition assumes a positive time value of money.It does not make periodic interest payments or have so-called coupons, hence the term zero coupon bond.When the bond reaches maturity, its investor receives its par (or face) value.

What are Zero coupon bonds ? | UPSC - IASbhai A zero-coupon bond is a debt security that does not pay interest but instead trades at a deep discount, rendering a profit at maturity, when the bond is redeemed for its full face value. Some bonds are issued as zero-coupon instruments from the start. While others bonds transform into zero-coupon instruments after a financial institution strips ...

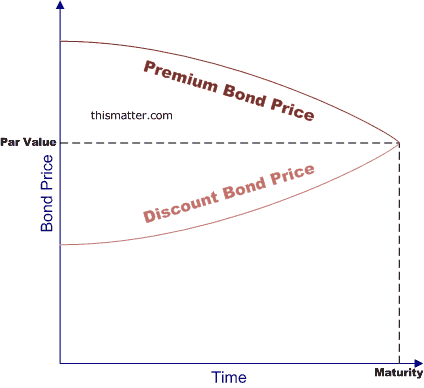

Zero-Coupon Bond - Definition, How It Works, Formula As a zero-coupon bond does not pay periodic coupons, the bond trades at a discount to its face value. To understand why, consider the time value of moneyTime Value of MoneyThe time value of money is a basic financial concept that holds that money in the present is worth more than the same sum of money to be received in the future.. The time value o...

Understanding Zero Coupon Bonds - Part One - The Balance Zero coupon bonds generally come in maturities from one to 40 years. The U.S. Treasury issues range from six months to 30 years and are the most popular ones, along with municipalities and corporations. 1. Here are some general characteristics of zero coupon bonds: You must pay tax on interest annually even though you don't receive it until ...

Zero Coupon Bond Funds: What Are They? - The Balance A zero coupon bond is a bond that doesn't offer interest payments but sells at a discount—a price lower than its face value. 1 The bondholder doesn't get paid while they own the bond, but when the bond matures, they will be repaid the full face value. Zero coupon bond funds are funds that hold these types of bonds.

Zero-Coupon Bonds : What is Zero Coupon Bond? - Groww No reinvestment risk: Other coupon bonds don't allow investors to a bond's cash flow at the same rate as the investment's required rate of returns. But the Zero Coupon bonds remove the reinvestment risk. Zero Coupon bonds do not allow any periodic coupon payments and thus a fixed interest on Zero Coupon bonds is assured.

Zero Coupon Bond | Investor.gov Because zero coupon bonds pay no interest until maturity, their prices fluctuate more than other types of bonds in the secondary market. In addition, although no payments are made on zero coupon bonds until they mature, investors may still have to pay federal, state, and local income tax on the imputed or "phantom" interest that accrues each year.

Should I Invest in Zero Coupon Bonds? | The Motley Fool Mar 24, 2018 · Specifically, if rates rise, they make the value of your zero coupon bond go down, potentially forcing you to sell at a depressed price if your timing is bad. Another problem with zero coupon bonds...

What Is a Zero-Coupon Bond? Definition, Advantages, Risks A zero-coupon bond doesn't pay periodic interest, but instead sells at a deep discount, paying its full face value at maturity. ... Finally, there is an inherent risk that the issuer of your bond ...

What Is a Zero-Coupon Bond? | The Motley Fool With zero-coupon bonds, interest rate risk is at its highest since zeros display unusual sensitivity to changes in interest rates -- although the underlying inverse relationship to interest rates...

6.2.1 Flashcards | Quizlet A risk-free, zero-coupon bond with a face value of $10,000 has 15 years to maturity. If the YTM is 6.1%, which of the following would be closest to the price this bond will trade at? A) $4937 B) $5760 C) $6582 D) $4114 D) Price = (Face value) / (1 + YTM)N. Price = ($10,000 ) / (1 + 6.1%)15 = $4114

Advantages and Risks of Zero Coupon Treasury Bonds Jan 31, 2022 · Unique Risks of Zero-Coupon U.S. Treasury Bonds Because of their sensitivity to interest rates, zero-coupon Treasury bonds have incredibly high interest rate risk. Treasury zeros fall significantly...

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/GettyImages-932585920-5c910a5846e0fb000172f0e8.jpg)

/DurationandConvexitytoMeasureBondRisk2-0429456c85984ad3b220cd23a760cda5.png)

Post a Comment for "42 zero coupon bonds risk"