45 zero coupon convertible bond

Airbus exercises option to redeem zero coupon convertible bonds Amsterdam, 29 November 2019 - Airbus SE (stock exchange symbol: AIR, the "Issuer") announces the exercise of its option to redeem its Zero Coupon Convertible Bonds due 1 July 2022 (the "Bonds") (ISIN: XS1254584599). The Issuer has notified the Trustee and the Bondholders that on 30 December 2019 (the "Optional Redemption Date ... Zero-Coupon Bonds : What is Zero Coupon Bond? - Groww Zero-Coupon Bond. In earlier days, companies used to raise funds from investors based on a written guarantee. This written guarantee is known as a bond. Coupon bonds provide coupons or interests at regular intervals. Zero-Coupon Bonds, as the name suggests, do not provide any coupon or interest during the tenure but repay the face value at the ...

Domestic bonds: DraftKings, 0% 15mar2028, USD (Conv.) US26142RAA23 19/03/2021. New bond issue: DraftKings issued bonds with a 0% coupon for USD 1,265.0m maturing in 2028. All organization news.

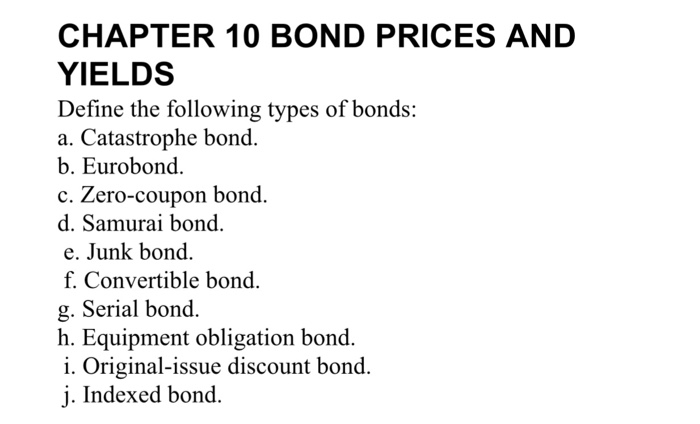

Zero coupon convertible bond

Zero Coupon Convertible Debenture Law and Legal Definition Zero Coupon Convertible Debenture/security is a zero coupon bond that is convertible into the common stock of the issuing company after the common stock reaches a certain price. A zero-coupon bond (also called a discount bond or deep discount bond) is a bond bought at a price lower than its face value. Zero Coupon Bond Calculator - What is the Market Price? - DQYDJ A zero coupon bond is a bond which doesn't pay any periodic payments. Instead it has only a face value (value at maturity) and a present value (current value). The entire face value of the bond is paid out at maturity. It is also known as a deep discount bond. Benefits and Drawbacks of Zero Coupon Bonds Zero-Coupon Bond: Formula and Calculator - Wall Street Prep To calculate the yield-to-maturity (YTM) on a zero-coupon bond, first divide the face value (FV) of the bond by the present value (PV). The result is then raised to the power of one divided by the number of compounding periods. Formula Yield-to-Maturity (YTM) = (FV / PV) ^ (1 / t) - 1 Interest Rate Risks and "Phantom Income" Taxes

Zero coupon convertible bond. Zero-Coupon Convertible - Investopedia A zero-coupon convertible can also refer to a zero-coupon issued by a municipality that can be converted to an interest-paying bond at a certain time before the maturity date. When a municipal... Journal Entry for Zero Coupon Bonds | Accounting Education Now, we are ready to pass the journal entries of zero coupon bonds. For example, A company issues $ 20,000 zero coupon bond in the market. Mr. David bought it at the discount of $ 3471. It means Mr. David bought it at $ 16529 at 10% per year his earning. At the end of second year, company has to pay only face value of $ 20000. Convertible Bonds: Definition and Example Calculation The convertible bond can be calculated by using the below formula: Where: C is coupon value, r is rate, n is year and CV is conversion value. Example: ABC Co has issued 100,000 units of convertible bonds with a nominal value of US$100 each. The coupon rate of the bonds is 10% payable annually. £350m Zero Coupon Guaranteed Convertible Bonds due 2020 On 9 June 2015, the Group issued £350m Zero Coupon Guaranteed Convertible Bonds due 2020.

Record Run for Zero-Interest Convertible Bonds Hits a Wall Investors gobbled up convertible bonds with zero coupon from companies including Airbnb, SoFi, Snap, Ford, DraftKings, Twitter, Shake Shack, Spotify and Dish Network. They were essentially lending... Zero-Coupon Bond Definition - Investopedia A zero-coupon bond is a debt security instrument that does not pay interest. Zero-coupon bonds trade at deep discounts, offering full face value (par) profits at maturity. The difference between... Invest in Zero Coupon Bond at Yubi | Learn All About It The formula for calculating the price of a zero coupon bond is: Price of bond = (Face value)/ (1+r)^n, where the face value is the bond's maturity value, r is the imputed interest rate, and n is the number of years to maturity. If the rate of interest is compounded semi-annually, then the formula changes to: Zero-Coupon Bonds: Pros and Cons - Management Study Guide Zero-coupon bonds are those bonds that are sold at a deep discount to their face value. This means that these bonds do not receive any periodic interest. Instead, the investors have to invest a lump sum amount at the beginning of their investment and get paid a higher lumpsum amount at the end of their investment.

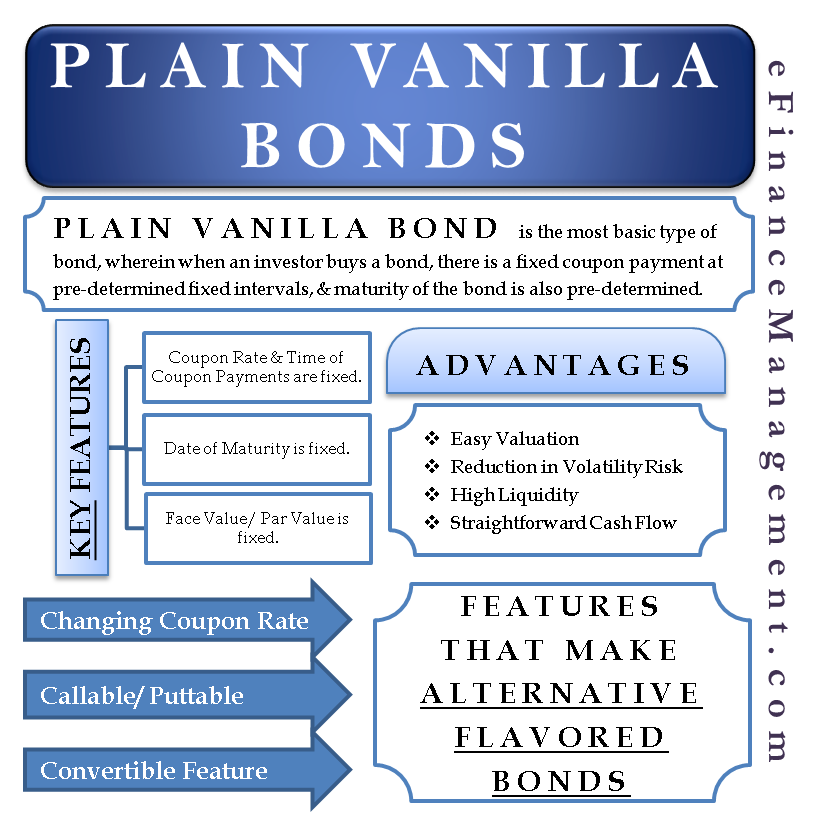

14.3 Accounting for Zero-Coupon Bonds - Financial Accounting This zero-coupon bond was sold for $2,200 below face value to provide interest to the buyer. Payment will be made in two years. The straight-line method simply recognizes interest of $1,100 per year ($2,200/2 years). Figure 14.11 December 31, Years One and Two—Interest on Zero-Coupon Bond at 6 Percent Rate—Straight-Line Method Zero coupon convertibles do not have a zero cost Zero coupon convertibles do not have a zero cost Published 11 May 2021 Convertible bond issuance is at a record high, with companies 'benefiting' from low interest rates and high equity volatility. A recent $1.44bn convertible bond issue by Twitter, with a zero coupon and conversion premium of 67%, is a good example. Why the zero coupon bond market is booming - Australian Financial Review But zero coupons are in fact quite common of late. Twitter, Airbnb, Dropbox, Beyond Meat and Ford have all issued zero coupon bonds with conversion prices of between 40 and 70 per cent above the... Zero-coupon convertible bond - TheFreeDictionary.com Zero-Coupon Convertible Bond 1. A bond that may be converted into common stock in the company issuing it. A zero-coupon convertible bond is sold at a discount from par and matures at par. They tend to be volatile in the secondary market because the convertible option may or may not become worthwhile, depending on how the company is performing.

ANA : Announcement on Issuance of Zero Coupon Convertible Bonds due ... Announcement on Issuance of Zero Coupon Convertible Bonds due 2031 ANA HOLDINGS INC. (the "Company") hereby announces that, at its board of directors' meeting held on 24 November 2021, the Company resolved to issue Zero Coupon Convertible Bonds due 2031 (the "Bonds") (the Bonds with stock acquisition rights, tenkanshasaigata shinkabu yoyakuken- tsuki shasai).

Duration and convexity of zero-coupon convertible bonds by S Sarkar · 1999 · Cited by 10 — The zero-coupon convertible bond has face value, F2, and also matures at t = T. The convertible holders have the option to convert the bonds to equity at ...

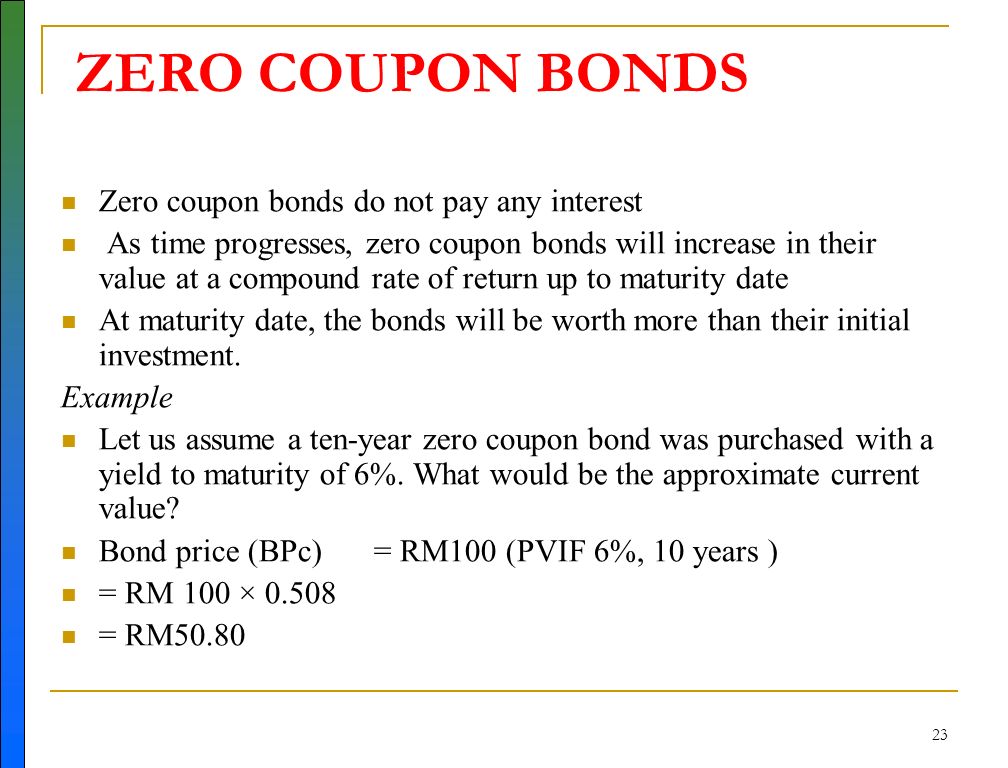

Zero Coupon Bond | Investor.gov Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due.

The One-Minute Guide to Zero Coupon Bonds | FINRA.org zero-coupon bond on the secondary market will likely fall. Instead of getting interest payments, with a zero you buy the bond at a discount from the face value of the bond, and are paid the face amount when the bond matures. For example, you might pay $3,500 to purchase a 20-year zero-coupon bond with a face value of $10,000.

Zero-coupon bond - Bogleheads Zero-coupon bonds or "zeros" result from the separation of coupons from the body of a security. Consequently, from a single coupon-paying bond, two bonds result: one which pays the coupons but returns no principal at maturity (an annuity), and one which pays no coupons but returns the par value at maturity (a zero-coupon bond).

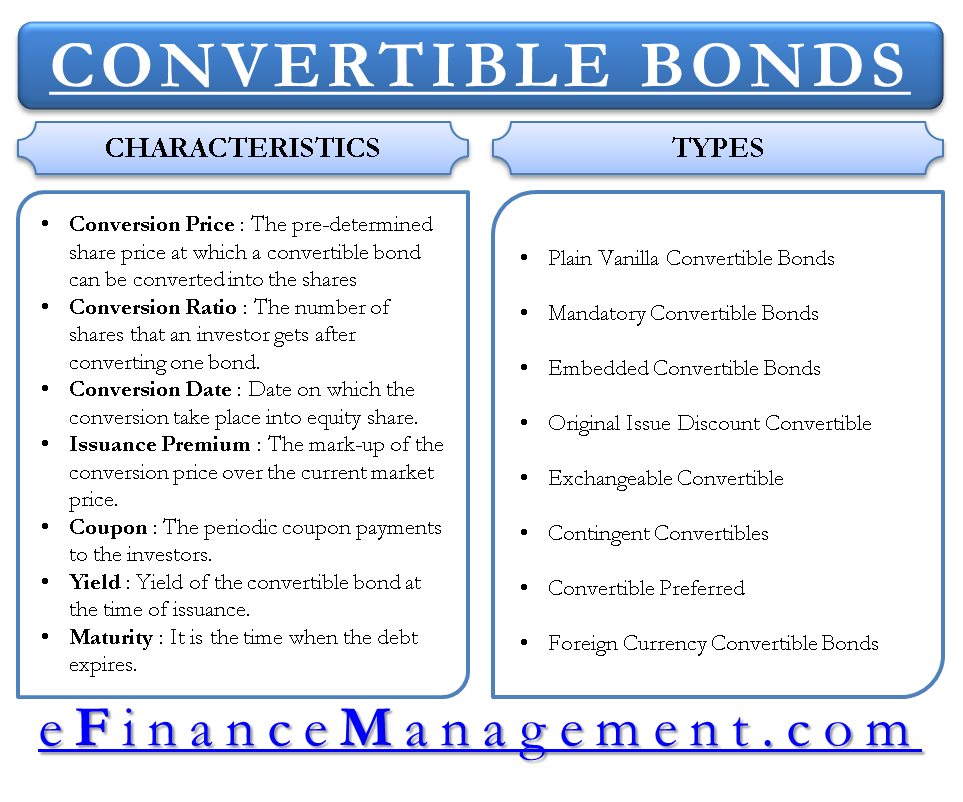

Zero-Coupon Convertible Zero - Coupon Convertible. A fixed income instrument that is a combination of a zero - coupon bond and a convertible bond. Due to the zero - coupon feature, the bond pays no interest and is issued at a discount to par value, while the convertible feature means that the bond is convertible into common stock of the issuer at a certain conversion ...

Zero Coupon Bond - (Definition, Formula, Examples, Calculations) Zero-Coupon Bond (Also known as Pure Discount Bond or Accrual Bond) refers to those bonds which are issued at a discount to its par value and makes no periodic interest payment, unlike a normal coupon-bearing bond. In other words, its annual implied interest payment is included in its face value which is paid at the maturity of such bond.

INT 02-05: Accounting for Zero Coupon Convertible Bonds The following is another example of a convertible bond, but the coupon rate is zero and the purchase price is at a premium (above par value). Thus, the insurer ...4 pages

Zero-coupon convertible bond - TheFreeDictionary.com Zero-Coupon Convertible Bond 1. A bond that may be converted into common stock in the company issuing it. A zero-coupon convertible bond is sold at a discount from par and matures at par. They tend to be volatile in the secondary market because the convertible option may or may not become worthwhile, depending on how the company is performing.

What Is a Zero-Coupon Bond? Definition, Advantages, Risks A zero-coupon bond doesn't pay periodic interest, but instead sells at a deep discount, paying its full face value at maturity. Zeros-coupon bonds are ideal for long-term, targeted financial needs...

Zero Coupon Bonds- Taxability Under Income Tax Act, 1961 - TaxWink Under Income Tax Act, 1961, Income derived from gain on sale of shares, debentures, bonds etc. attracts taxability under the head of "Capital Gains". Such gain is either taxable as short term capital gain or long term capital gain. In this article, we will discuss the concept of "Zero Coupon Bonds" and throw light on taxing aspects of ...

Zero-coupon bond - Wikipedia A zero coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. [1] Unlike regular bonds, it does not make periodic interest payments or have so-called coupons, hence the term zero-coupon bond. When the bond reaches maturity, its investor receives its par (or face) value.

SGX fully places out zero coupon convertible bonds The Singapore Exchange (SGX) has fully placed out €240 million (S$386 million) of its zero coupon convertible bonds due March 1, 2024, with a "high-quality book of institutional investors ...

Zero-Coupon Bond - Definition, How It Works, Formula John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded annually. What price will John pay for the bond today? Price of bond = $1,000 / (1+0.05) 5 = $783.53 The price that John will pay for the bond today is $783.53. Example 2: Semi-annual Compounding

Zero-coupon convertible bonds - YieldCurve.com Zero-coupon convertible bonds or “optional convertible notes” (OCNs) are well- established in the market. When they are issued at a discount to par, ...9 pages

Zero-Coupon Bond: Formula and Calculator - Wall Street Prep To calculate the yield-to-maturity (YTM) on a zero-coupon bond, first divide the face value (FV) of the bond by the present value (PV). The result is then raised to the power of one divided by the number of compounding periods. Formula Yield-to-Maturity (YTM) = (FV / PV) ^ (1 / t) - 1 Interest Rate Risks and "Phantom Income" Taxes

Zero Coupon Bond Calculator - What is the Market Price? - DQYDJ A zero coupon bond is a bond which doesn't pay any periodic payments. Instead it has only a face value (value at maturity) and a present value (current value). The entire face value of the bond is paid out at maturity. It is also known as a deep discount bond. Benefits and Drawbacks of Zero Coupon Bonds

Zero Coupon Convertible Debenture Law and Legal Definition Zero Coupon Convertible Debenture/security is a zero coupon bond that is convertible into the common stock of the issuing company after the common stock reaches a certain price. A zero-coupon bond (also called a discount bond or deep discount bond) is a bond bought at a price lower than its face value.

![PDF] Duration and convexity of zero-coupon convertible bonds ...](https://d3i71xaburhd42.cloudfront.net/39b5487ce4f8becdfb0faf5ae6e30fd10537436c/8-Figure2-1.png)

/ConvertibleBondsPrice2-2285ff1211c545be919565380a232a02.png)

![PDF] Duration and convexity of zero-coupon convertible bonds ...](https://d3i71xaburhd42.cloudfront.net/39b5487ce4f8becdfb0faf5ae6e30fd10537436c/10-Figure3-1.png)

Post a Comment for "45 zero coupon convertible bond"