40 define zero coupon bond

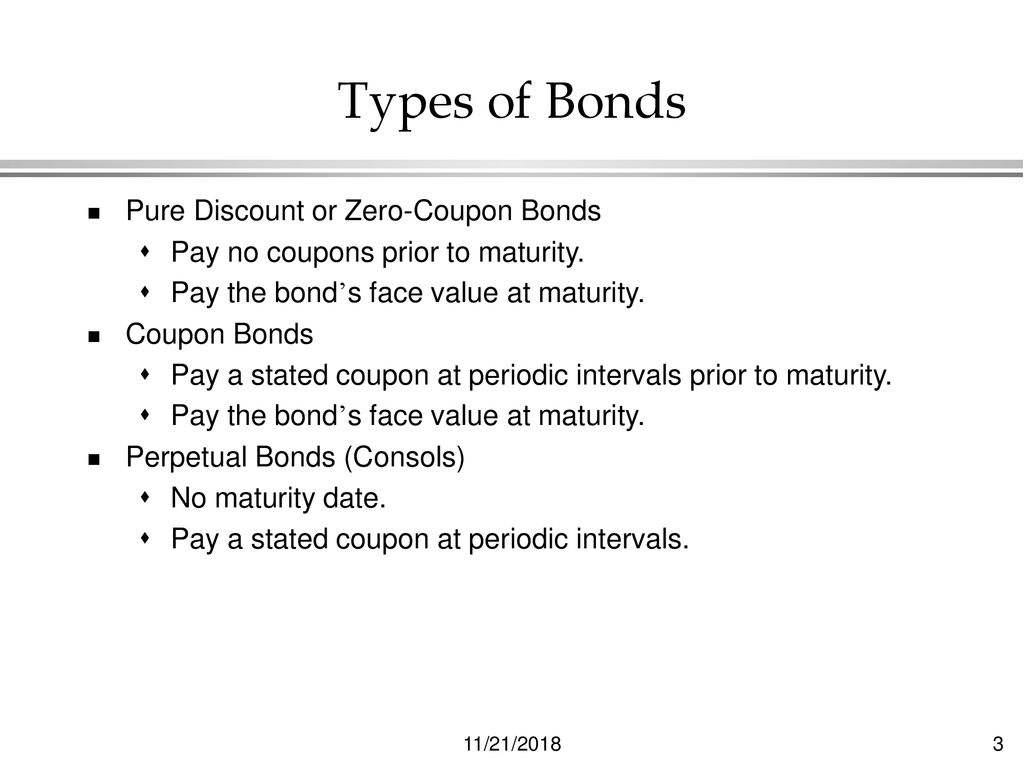

Zero coupon bond - definition of zero coupon bond by The Free Dictionary Noun 1. zero coupon bond - a bond that is issued at a deep discount from its value at maturity and pays no interest during the life of the bond; the commonest form of zero-coupon security zero-coupon bond Zero coupon bond financial definition of zero coupon bond Zero-coupon bonds, especially issues with long maturities, tend to have very volatile prices. Buy a zero-coupon bond with a 25-year maturity and watch the price plummet if market interest rates increase. Of course, the opposite also holds true. A long-term zero-coupon bond will produce substantial gains in value when market rates of interest ...

What is a Zero-Coupon Bond? Definition, Features, Advantages ... Definition: A zero-coupon bond, as the name suggests, it is a financial instrument which does not allow a regular interest payment to the investor. Moreover, it is a bond which is issued at a meagre market price (discounted price) in comparison to its face value. And it is redeemable on or after a specified maturity date at the par value itself.

Define zero coupon bond

Pro Rata: What It Means and the Formula to Calculate It - Investopedia Jul 18, 2022 · Pro-Rata: Pro rata is the term used to describe a proportionate allocation. It is a method of assigning an amount to a fraction according to its share of the whole. While a pro rata calculation ... Accounts That Earn Compounding Interest | The Motley Fool Sep 28, 2022 · A zero-coupon bond holder purchases a bond at a steep discount, receives no interest payments (coupons) in exchange for holding the bond, and is paid the bond's face value when the bond is due ... Zero-Coupon Bond Definition - Investopedia A zero-coupon bond is a debt security instrument that does not pay interest. Zero-coupon bonds trade at deep discounts, offering full face value (par) profits at maturity. The difference between...

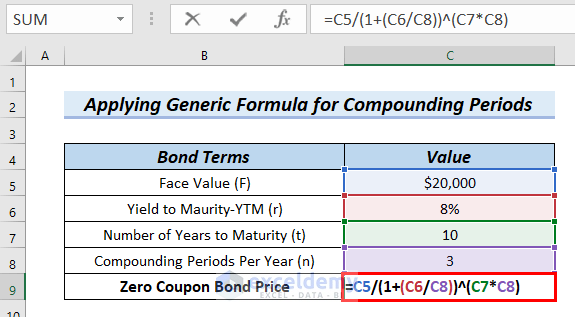

Define zero coupon bond. Zero Coupon Bond | Investor.gov Zero Coupon Bond Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. The maturity dates on zero coupon bonds are usually long-term—many don’t mature for … Zero-Coupon Bonds and Taxes - Investopedia A zero-coupon bond will usually have higher returns than a regular bond with the same maturity because of the shape of the yield curve. Zero-coupon bonds are more volatile than coupon bonds, so... Zero Coupon Bond - (Definition, Formula, Examples, Calculations) Zero-Coupon Bond (Also known as Pure Discount Bond or Accrual Bond) refers to those bonds which are issued at a discount to its par value and makes no periodic interest payment, unlike a normal coupon-bearing bond. In other words, its annual implied interest payment is included in its face value which is paid at the maturity of such bond. What Is a Zero-Coupon Bond? Definition, Advantages, Risks A zero-coupon bond doesn't pay periodic interest, but instead sells at a deep discount, paying its full face value at maturity. Zeros-coupon bonds are ideal for long-term, targeted financial needs...

Zero-Coupon Bond: Definition, Formula, Example etc. Zero-Coupon Bond is a debt security where the investors will not get any interest against his invested money but he will get a big discount while purchasing the bond. At the time of maturity, when the investor will go to the liquidation he will receive the full face value amount. Normally, a zero coupon bond has a higher return than the regular ... Zero Coupon Bond | Investor.gov Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. Zero-coupon-bond definition - YourDictionary Define zero-coupon-bond. Zero-coupon-bond as a means A bond that pays no interest until it matures. It is priced at a deep discount to make up for the lack of income. These .... Zero-coupon bond financial definition of Zero-coupon bond Zero-Coupon Bond A bond that pays no interest. It is sold at a discount from par and matures at par. These are fairly illiquid investments because they do not benefit from changes in interest rates. However, they tend to be low- risk. Zero-coupon bonds fluctuate in price, sometimes dramatically, with changes in interest rates.

Zero Coupon Bonds financial definition of Zero Coupon Bonds Zero-Coupon Bond A bond that pays no interest. It is sold at a discount from par and matures at par. These are fairly illiquid investments because they do not benefit from changes in interest rates. However, they tend to be low- risk. Zero-coupon bonds fluctuate in price, sometimes dramatically, with changes in interest rates. WACC: What is the Weighted Average Cost of Capital? - Wall … The risk-free rate should reflect the yield of a default-free government bond of equivalent maturity to the duration of each cash flow being discounted. The current yield on a U.S. 10-year bond is the preferred proxy for the risk-free rate for U.S. companies. For European companies, the German 10-year is the preferred risk-free rate. What Is Bond Yield? - Investopedia May 31, 2022 · Bond Yield: A bond yield is the amount of return an investor realizes on a bond. Several types of bond yields exist, including nominal yield which is the interest paid divided by the face value of ... Zero-Coupon Bond - Definition, How It Works, Formula A zero-coupon bond is a bond that pays no interest. The bond trades at a discount to its face value. Reinvestment risk is not relevant for zero-coupon bonds, but interest rate risk is relevant for the bonds. Understanding Zero-Coupon Bonds As a zero-coupon bond does not pay periodic coupons, the bond trades at a discount to its face value.

Zero Coupon Bond | Definition, Formula & Examples - Study.com A zero-coupon bond, which is also referred to as "an accrual bond", is a debt security that does not provide investors with periodic payments or periodic interests. Instead, this type of financial...

What is a Zero-Coupon Bond? - Robinhood A zero-coupon bond is a bond that doesn't result in recurring interest income for the bondholder. The owner buys the bond at a discount, and the difference between the bond's purchase price and face value is the profit. ... Definition: A zero-coupon bond is a type of debt security that trades at a discount and where the only payment occurs ...

Zero-coupon bond - definition of zero-coupon bond by The Free Dictionary Noun 1. zero-coupon bond - a bond that is issued at a deep discount from its value at maturity and pays no interest during the life of the bond; the commonest form of zero-coupon security zero coupon bond

The Great Reset: The Bond Yield-Dollar Feedback Loop Sep 30, 2022 · Via Global Macro Monitor, The Great Reset is upon us. All things as we have known and have become comfortably numb with, such as zero interest rates, negative real interest rates, quantitative easing (digital money printing), and Pax Americana, [and central bank dominance of the U.S. bond market] are being upended and overturned. Beware of recency …

Zero-coupon bond - Wikipedia A zero coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. Unlike regular bonds, it does not make periodic interest payments or have so-called coupons, hence the term zero-coupon bond.When the bond reaches maturity, its investor receives its par (or face) value. Examples of zero-coupon bonds include US Treasury bills, US ...

Convexity of a Bond | Formula | Duration | Calculation Convexity is a risk management tool used to define how risky a bond is as more the convexity of the bond; more is its price sensitivity to interest rate movements. ... While the duration of the zero-coupon bond Zero-coupon Bond In contrast to a typical coupon-bearing bond, a zero-coupon bond (also known as a Pure Discount Bond or Accrual Bond ...

What Is a Zero-Coupon Bond? Definition, Characteristics & Example Like regular bonds, zero-coupon bonds are financial securities that mature over time, and their face (par) value is paid to their holder at the end of their term. Unlike coupon-paying bonds,...

What is a Zero Coupon Bond? - Definition | Meaning | Example A Zero coupon bond is a bond that sells without a stated rate of interest. This way the company or government doesn't have to worry about changing interest rates. These bonds are sold at a discount don't pay a standard monthly interest percentage like normal bonds do. Instead, investors receive the gain of the appreciated bond at maturity.

Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia Zero-coupon U.S. Treasury bonds are also known as Treasury zeros, and they often rise dramatically in price when stock prices fall. Zero-coupon U.S. Treasury bonds can move up significantly when...

HCPCS level II Flashcards | Quizlet The trustee uses the annual payments to retire a portion of the issue each year, calling a given percentage of the issue by a lottery and paying a specified price per bond or buying bonds on the open market, whichever is cheaper. What are the advantages and disadvantages of each procedure from the viewpoint of the firm and the bondholders?

Answered: a. You purchased a new issue GE Corp… | bartleby Sep 29, 2022 · a. You purchased a new issue GE Corp bond. The bond has a face value of $100, coupon interest rate of 4%, and a maturity of 10 years. Four (4) years later you sell the bond in the secondary market; however, market interest rates for bonds of equal risk and maturity are now 3.5%. Calculate the selling price of your bond.

Understanding Fixed-Income Risk and Return - CFA Institute The total return is the future value of reinvested coupon interest payments and the sale price (or redemption of principal if the bond is held to maturity).The horizon yield (or holding period rate of return) is the internal rate of return between the total return and purchase price of the bond. Coupon reinvestment risk increases with a higher ...

Zero-Coupon Bond Definition - Investopedia A zero-coupon bond is a debt security instrument that does not pay interest. Zero-coupon bonds trade at deep discounts, offering full face value (par) profits at maturity. The difference between...

Accounts That Earn Compounding Interest | The Motley Fool Sep 28, 2022 · A zero-coupon bond holder purchases a bond at a steep discount, receives no interest payments (coupons) in exchange for holding the bond, and is paid the bond's face value when the bond is due ...

Pro Rata: What It Means and the Formula to Calculate It - Investopedia Jul 18, 2022 · Pro-Rata: Pro rata is the term used to describe a proportionate allocation. It is a method of assigning an amount to a fraction according to its share of the whole. While a pro rata calculation ...

:max_bytes(150000):strip_icc():gifv()/zero-couponbond_final-a6ec3618516a49c9a3654a1c79c9b681.png)

Post a Comment for "40 define zero coupon bond"