45 what are coupon payments

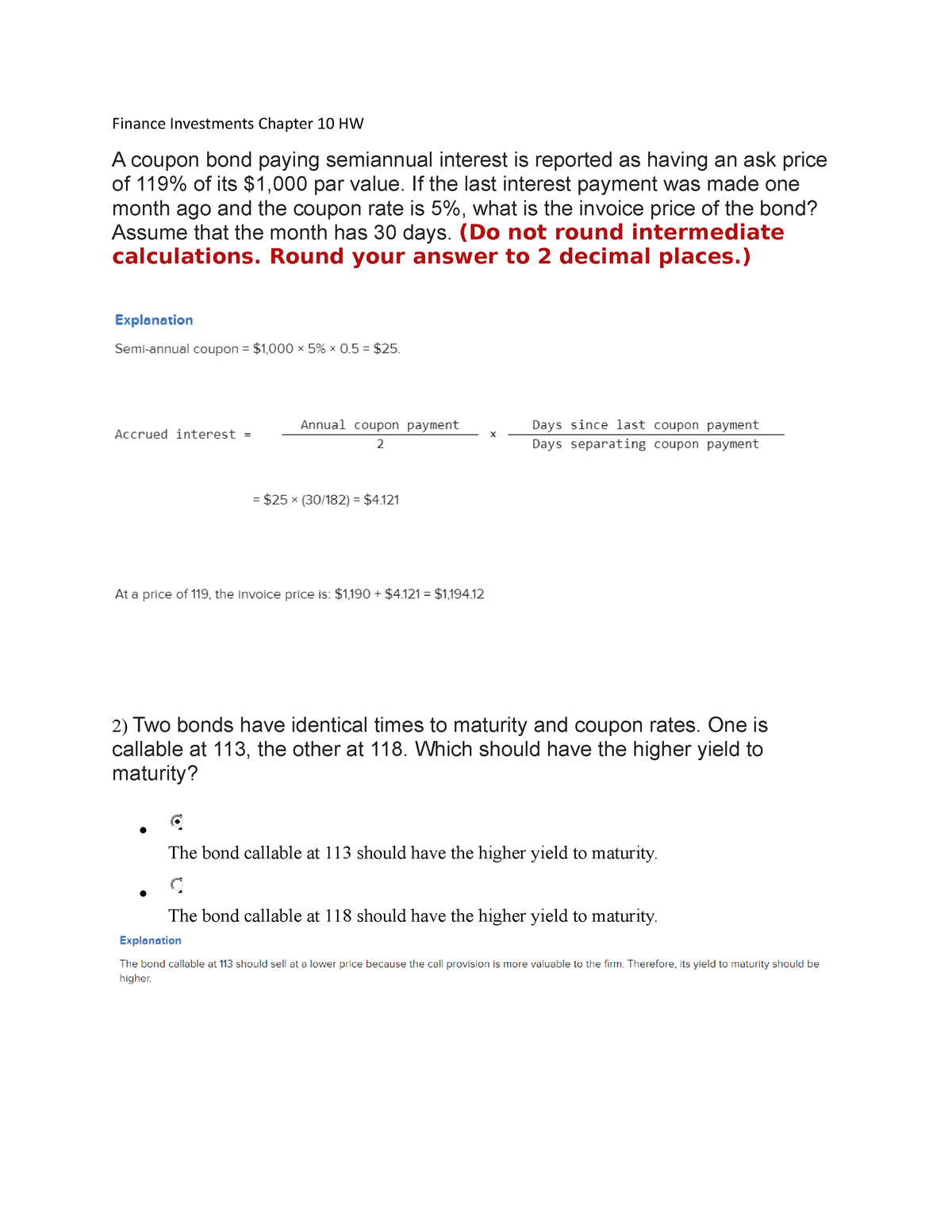

Coupon Definition - Investopedia A coupon or coupon payment is the annual interest rate paid on a bond, expressed as a percentage of the face value and paid from issue date until maturity. Coupons are usually referred to in terms... What is Coupon payment | Capital.com A coupon payment is the annual interest payment made by the issuer of a bond to the bondholder until it reaches maturity. Read our definition to find out more. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 81.40% of retail investor accounts lose money when trading CFDs with this provider .

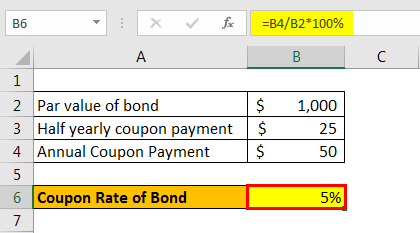

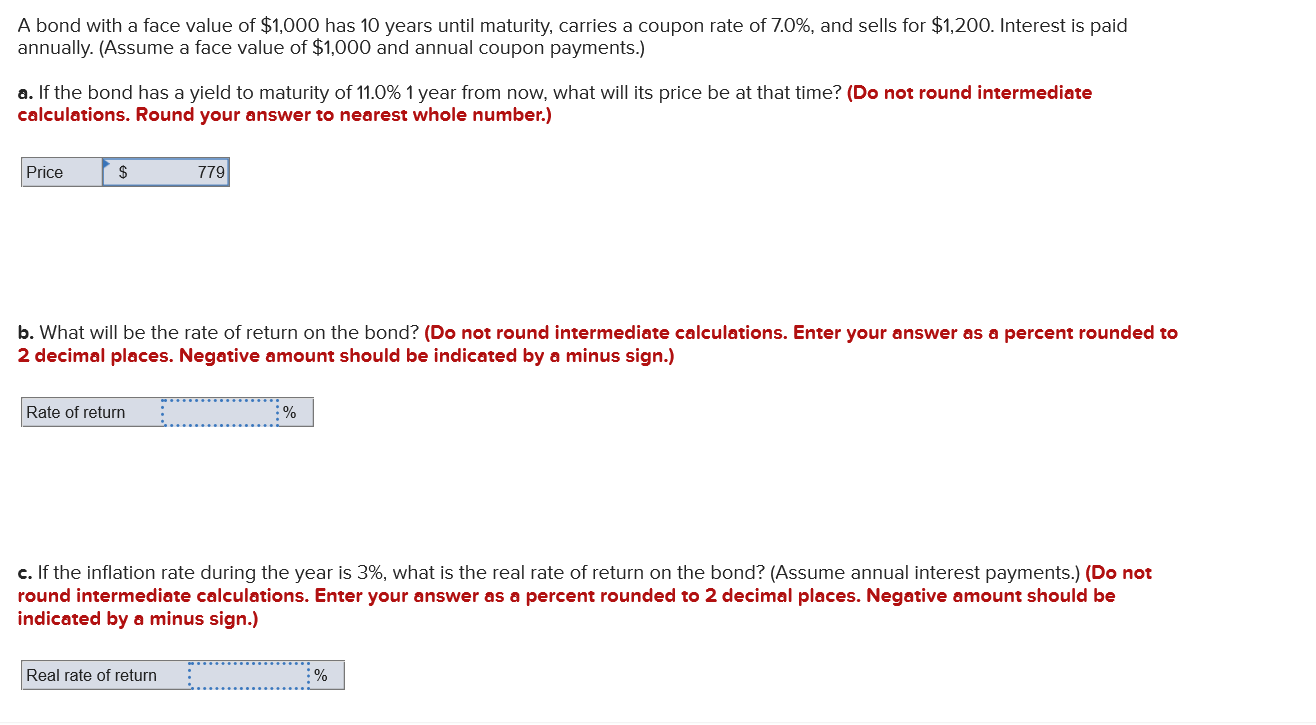

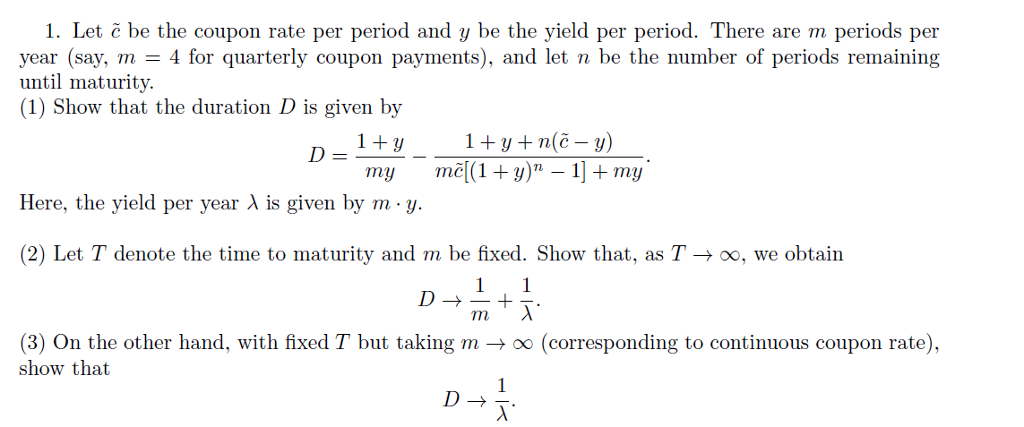

Coupon Rate Definition - Investopedia May 28, 2022 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ...

What are coupon payments

Coupon Definition - Investopedia Apr 02, 2020 · Coupon: The annual interest rate paid on a bond, expressed as a percentage of the face value. Credit Suisse Announces Coupon Payments and Expected Coupon Payments … Jul 07, 2022 · Coupon payments for the ETNs (if any) are variable and do not represent fixed, periodic interest payments. The Expected Coupon Amount for any ETN may vary significantly from coupon period to ... Coupon Bond - Guide, Examples, How Coupon Bonds Work A coupon bond is a type of bond that includes attached coupons and pays periodic (typically annual or semi-annual) interest payments during its lifetime and its par value at maturity. These bonds come with a coupon rate, which refers to the bond's yield at the date of issuance.

What are coupon payments. Polyus Finance Plc: Update on coupon payments in respect of 2023 Notes ... The issuer is solely responsible for the content of this announcement. 22 September 2022. Polyus Finance Plc announces an update on coupon payments in respect of its outstanding U.S.$800,000,000 5.25% Guaranteed Notes due 2023. NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION IN OR INTO, OR TO ANY PERSON LOCATED OR RESIDENT IN, ANY JURISDICTION ... Credit Suisse Announces Coupon Payments and Expected Coupon Payments on ... Coupon payments for the ETNs (if any) are variable and do not represent fixed, periodic interest payments. The Expected Coupon Amount for any ETN may vary significantly from coupon period to ... Coupon Bond - Investopedia Mar 31, 2020 · Coupon Bond: A coupon bond, also referred to as a bearer bond, is a debt obligation with coupons attached that represent semi-annual interest payments. With coupon bonds, there are no records of ... Coupon Payment | Definition, Formula, Calculator & Example A coupon payment is the amount of interest which a bond issuer pays to a bondholder at each payment date. Bond indenture governs the manner in which coupon payments are calculated. Bonds may have fixed coupon payments, variable coupon payments, deferred coupon payments and accelerated coupon payments.

Coupon Rate Definition - Investopedia The coupon rate, or coupon payment, is the nominal yield the bond is stated to pay on its issue date. This yield changes as the value of the bond changes, thus giving the bond's yield to maturity... Coupon payments financial definition of Coupon payments Coupon payments are expressed as a percentage of the face value ( par) of a bond. For example, if one holds a bond worth $100,000 at 5% interest, the bondholder will receive $5,000 in coupon payments per year (or, more strictly, $2,500 every six months) until the bond matures or he/she sells the bond. UBS declares coupon payments on 5 ETRACS Exchange Traded Notes - Yahoo! NEW YORK, August 08, 2022 -- ( BUSINESS WIRE )--UBS Investment Bank today announced coupon payments for 5 ETRACS Exchange Traded Notes (the "ETNs"), all traded on the NYSE Arca. * The table above ... Unlock digital opportunities with the world’s most trusted … Make smarter business decisions knowing how consumers and businesses manage their money, borrow and make payments. Health → Explore our healthcare research which analyzes the aspects being transformed by tech and creating opportunities for providers and payers.

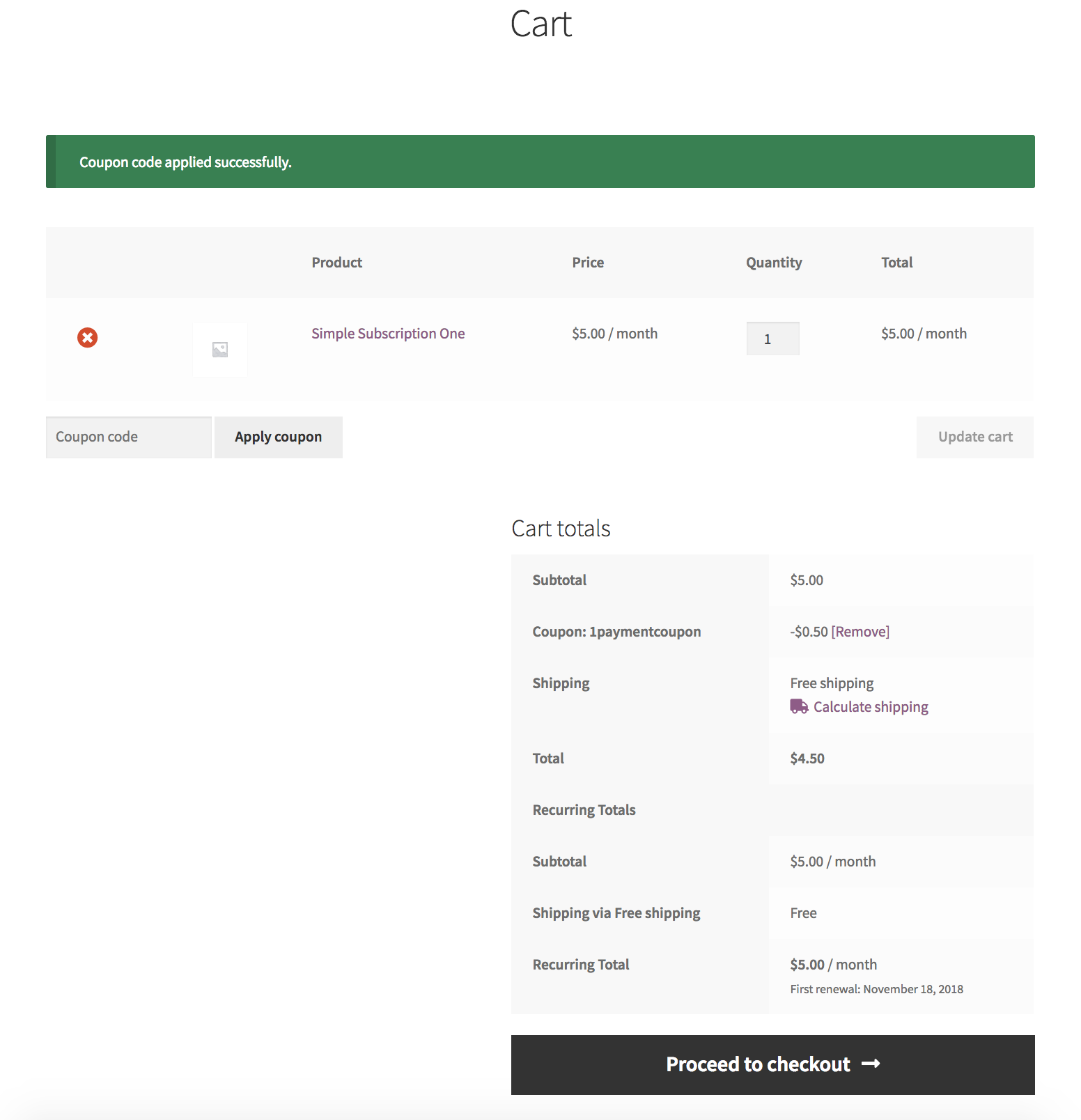

How It Works - Sezzle Split your entire order into 4 interest-free payments over 6 weeks. No fees if you pay on time with zero impact to your credit. Buy from your favorite stores today, and split up the cost into four interest-free payments. What Is a Coupon Payment? - Smart Capital Mind A coupon payment is a payment made to the holder of a bond for the interest that bond accrues while it is maturing. This is typically made as a semi-annual payment, so only half of the interest owed on the bond is paid at a time. Coupon Bond - Investopedia A coupon bond, also referred to as a bearer bond or bond coupon, is a debt obligation with coupons attached that represent semiannual interest payments. With coupon bonds, there are no records of... All classifieds - Veux-Veux-Pas, free classified ads Website All classifieds - Veux-Veux-Pas, free classified ads Website. Come and visit our site, already thousands of classified ads await you ... What are you waiting for? It's easy to use, no lengthy sign-ups, and 100% free! If you have many products or ads, create your own online store (e-commerce shop) and conveniently group all your classified ads in your shop! Webmasters, …

Credit Suisse Announces Coupon Payments and Expected Coupon Payments on ... Coupon payments for the ETNs (if any) are variable and do not represent fixed, periodic interest payments. The Expected Coupon Amount for any ETN may vary significantly from coupon period to ...

What Are Coupon Payments? - ClydeBank Media Coupon payment is the periodic payment of interest by a bond issuer to a bondholder. Coupon payment is not to be confused with stock dividend payment—the two are distinct in a few ways. When an investor or trader purchases shares of stock in a company, they are purchasing the rights to a portion of that company's profits.

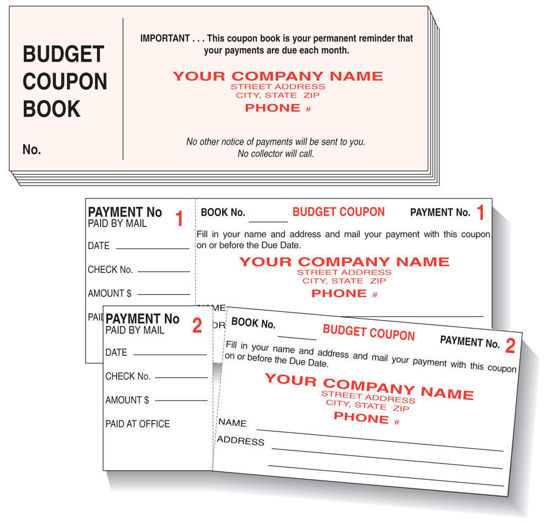

What is a Coupon Payment? - Definition | Meaning | Example Coupon payments are vital incentives to investors who are attracted to lower risk investments. These payments get their name from previous generations of bonds that had a physical, tear off coupon that investors had to physically hand in to the issuer as evidence that they owned the bond. It was also used as a way to track the steady payment stream to investors.

Coupon Payments Definition | Law Insider Coupon Payments means coupon payments, the details of which will be specified in the applicable Pricing Supplement. Coupon Payments. - means the payments representing distributions of profits (or return of capital) in relation to the Trustee LP that the ABC Arrangement provides for the Scheme trustee to receive. Coupon Payments.

UBS declares coupon payments on 5 ETRACS Exchange Traded Notes NEW YORK, September 07, 2022 -- ( BUSINESS WIRE )--UBS Investment Bank today announced coupon payments for 5 ETRACS Exchange Traded Notes (the "ETNs"), all traded on the NYSE Arca. * The table ...

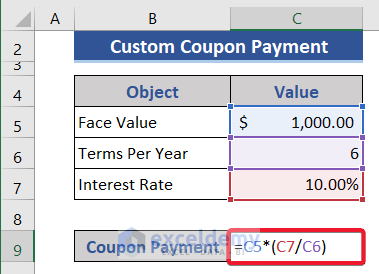

Coupon Payment Calculator The coupon payment is the interest paid by a bond issuer to a bondholder at each payment period until the bond matures or it is called. The payment schedule can be quarterly, semiannually or annually, depending on the agreed time. When a bond is first issued, the bond's price is its face value.

UBS declares coupon payments on 5 ETRACS Exchange Traded Notes CEFD and MVRL pay a variable monthly coupon linked to 1.5 times the cash distributions, if any, on the respective underlying index constituents, less withholding taxes, if any.

UBS declares coupon payments on 5 ETRACS Exchange Traded … Sep 07, 2022 · NEW YORK, September 07, 2022--UBS Investment Bank today announced coupon payments for 5 ETRACS Exchange Traded Notes (the "ETNs"), all traded on the NYSE Arca.

Credit Suisse Announces Coupon Payments and Expected Coupon Payments … Sep 08, 2022 · Coupon payments for the ETNs (if any) are variable and do not represent fixed, periodic interest payments. The Expected Coupon Amount for any ETN may vary significantly from coupon period to ...

Coupon (finance) - Wikipedia In finance, a coupon is the interest payment received by a bondholder from the date of issuance until the date of maturity of a bond.. Coupons are normally described in terms of the "coupon rate", which is calculated by adding the sum of coupons paid per year and dividing it by the bond's face value.For example, if a bond has a face value of $1,000 and a coupon rate of 5%, then it …

Polyus Finance Plc: Update on coupon payments in respect of 2023 Notes ... Update on coupon payments in respect of 2023 Eurobonds. Under the terms of the Notes the Issuer was instructed to transfer the funds to the account of i2 Capital Trust Corporation Ltd, acting as a trustee under the Notes (the "Trustee"), as coupon payments for the subsequent transfer of such funds to the clearing systems for onward payment ...

Coupon (finance) - Wikipedia In finance, a coupon is the interest payment received by a bondholder from the date of issuance until the date of maturity of a bond. Coupons are normally described in terms of the "coupon rate", which is calculated by adding the sum of coupons paid per year and dividing it by the bond's face value. For example, if a bond has a face value of $1,000 and a coupon rate of 5%, then it pays total coupons of $50 per year. Typically, this will consist of two semi-annual payments of $25 each. 1945 2.5%

How to Calculate a Coupon Payment: 7 Steps (with Pictures) - wikiHow Since bondholders generally receive their coupon payments semiannually, you just divide the annual coupon payment by two to receive the actual coupon payment. For example, if the annual coupon payment is $80, then the actual coupon payment is $80/2 or $40. Tips The calculations above will work equally well when expressed in other currencies.

Coupon Bond - Guide, Examples, How Coupon Bonds Work A coupon bond is a type of bond that includes attached coupons and pays periodic (typically annual or semi-annual) interest payments during its lifetime and its par value at maturity. These bonds come with a coupon rate, which refers to the bond's yield at the date of issuance.

Credit Suisse Announces Coupon Payments and Expected Coupon Payments … Jul 07, 2022 · Coupon payments for the ETNs (if any) are variable and do not represent fixed, periodic interest payments. The Expected Coupon Amount for any ETN may vary significantly from coupon period to ...

Coupon Definition - Investopedia Apr 02, 2020 · Coupon: The annual interest rate paid on a bond, expressed as a percentage of the face value.

:max_bytes(150000):strip_icc()/dotdash_INV-final-How-Can-I-Calculate-a-Bonds-Coupon-Rate-in-Excel-June-2021-01-8ff43b6e77a4475fb98d82707a90fae0.jpg)

/dotdash_INV-final-How-Can-I-Calculate-a-Bonds-Coupon-Rate-in-Excel-June-2021-01-8ff43b6e77a4475fb98d82707a90fae0.jpg)

/dotdash_INV-final-How-Can-I-Calculate-a-Bonds-Coupon-Rate-in-Excel-June-2021-01-8ff43b6e77a4475fb98d82707a90fae0.jpg)

Post a Comment for "45 what are coupon payments"