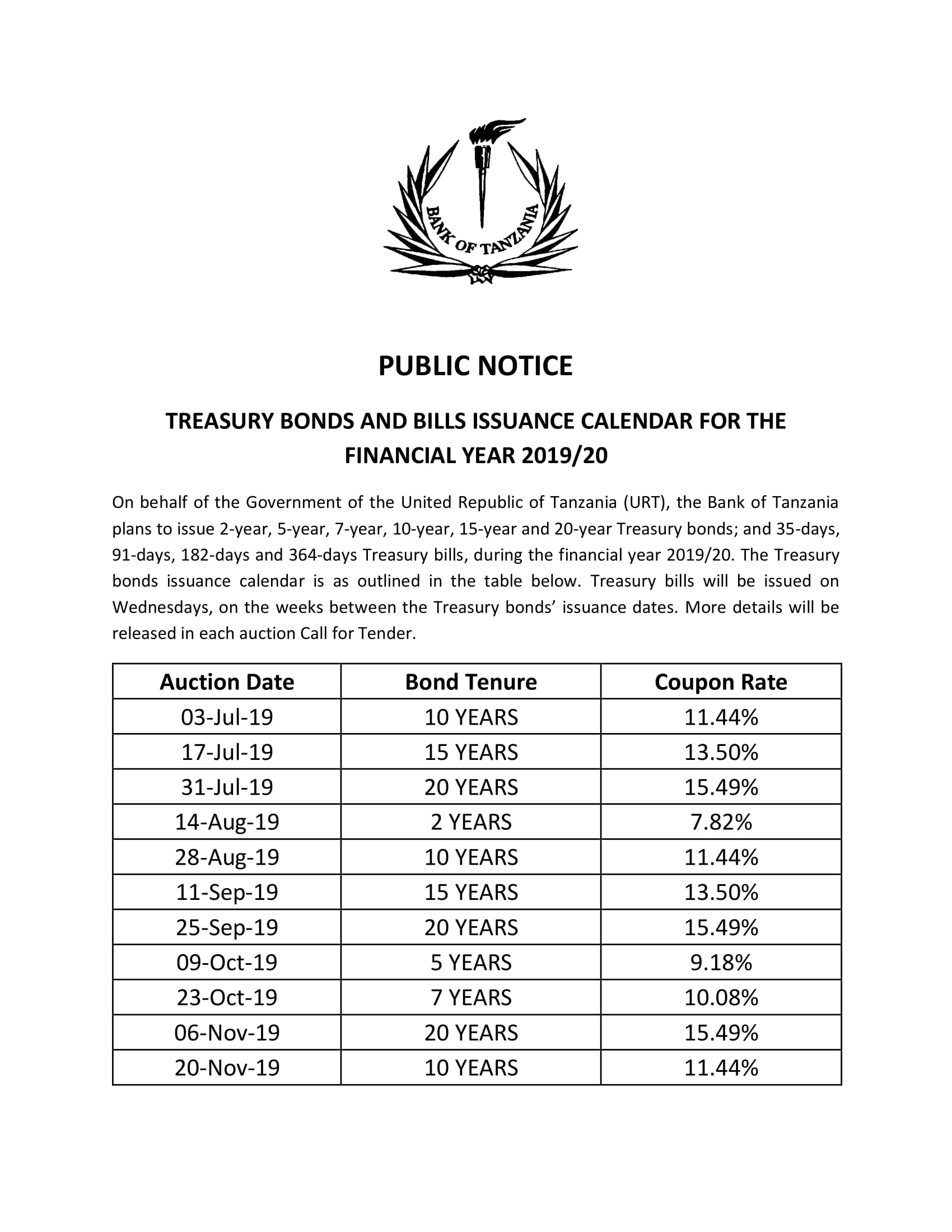

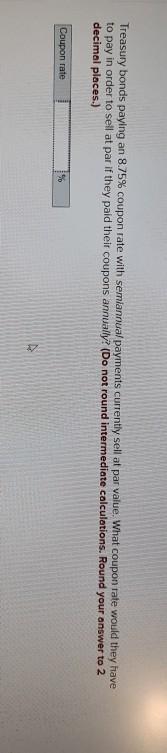

38 treasury bills coupon rate

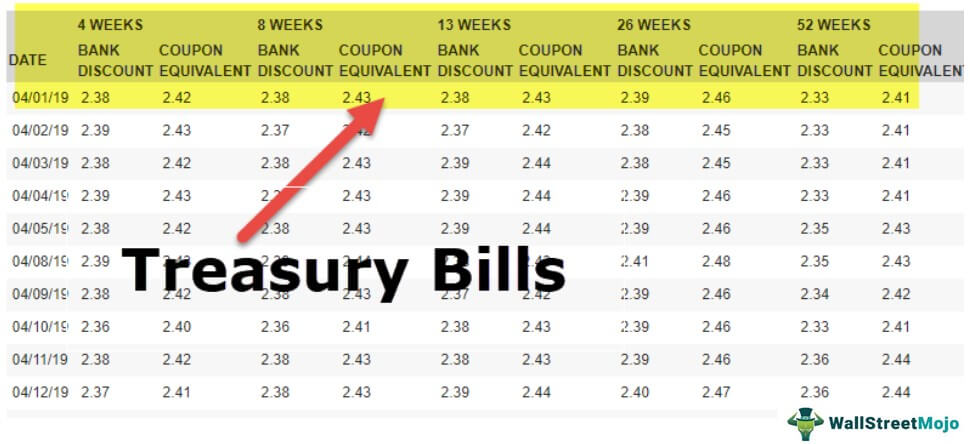

Understanding Pricing and Interest Rates — TreasuryDirect A $1,000 26-week bill sells at auction for a discount rate of 0.145%. Price = 1000 (1 - (.00145 x 180)/360) = $999.27 The formula shows that the bill sells for $999.27, giving you a discount of $0.73. When you get $1,000 after 26 weeks, you have earned $0.73 in "interest." Bonds and Notes United States Rates & Bonds - Bloomberg Name Coupon Price Yield 1 Month 1 Year Time (EDT) GTII5:GOV . 5 Year

6 Month Treasury Bill Rate - YCharts 6 Month Treasury Bill Rate is at 4.45%, compared to 4.46% the previous market day and 0.07% last year. This is lower than the long term average of 4.48%. Stats Related Indicators Treasury Yield Curve

Treasury bills coupon rate

Coupon Equivalent Rate (CER) Definition - Investopedia Coupon Equivalent Rate - CER: A alternative calculation of coupon rate used to compare zero-coupon and coupon fixed-income securities. Formula: What Are Treasury Bills (T-Bills) and How Do They Work? - Investopedia As stated earlier, the Treasury Department auctions new T-bills throughout the year. On March 28, 2019, the Treasury issued a 52-week T-bill at a discounted price of $97.613778 to a $100... How Is the Interest Rate on a Treasury Bond Determined? - Investopedia Aug 29, 2022 · This is known as the coupon rate. For example, a $10,000 T-bond with a 5% coupon will pay out $500 annually, regardless of what price the bond is trading for in the market. Factors Affecting ...

Treasury bills coupon rate. Interest Rate Statistics | U.S. Department of the Treasury Daily Treasury Bill Rates These rates are indicative closing market bid quotations on the most recently auctioned Treasury Bills in the over-the-counter market as obtained by the Federal Reserve Bank of New York at approximately 3:30 PM each business day. View the Daily Treasury Bill Rates Daily Treasury Long-Term Rates and Extrapolation Factors Treasury Bills — TreasuryDirect Treasury Bills. We sell Treasury Bills (Bills) for terms ranging from four weeks to 52 weeks. Bills are sold at a discount or at par (face value). When the bill matures, you are paid its face value. You can hold a bill until it matures or sell it before it matures. Note about Cash Management Bills: We also sell Cash Management Bills (CMBs) at ... Role of the Treasury | U.S. Department of the Treasury Treasury's mission highlights its role as the steward of U.S. economic and financial systems, and as an influential participant in the world economy. The Treasury Department is the executive agency responsible for promoting economic prosperity and ensuring the financial security of the United States. The Department is responsible for a wide range of activities such as advising … Treasury Bills (T-Bills) - What They Are & How to Buy for … Sep 14, 2021 · Treasury bills (T-bills) are a great way to put your hard-earned dollars to work for you. ... While most fixed-income securities like bonds pay interest in the form of coupon rates, there is no interest offered when investing in T-bills. When a T-bill matures, investors receive the full face value of the bill, often referred to as the par value ...

What Are Treasury Bills (T-Bills) and How Do They Work? - Investopedia Jun 02, 2022 · Treasury Bill - T-Bill: A Treasury bill (T-Bill) is a short-term debt obligation backed by the Treasury Dept. of the U.S. government with a maturity of less than one year, sold in denominations of ... Treasury bills indexed to TONIA — METIKAM Treasury bills indexed to the TONIA rate (METIKAM) are long-term coupon securities issued by the Ministry of Finance of the Republic of Kazakhstan. The maturity of these securities is more than one year, the nominal value is 1000 tenge, the income is paid in the form of a coupon twice a year. Placement and redemption of securities takes place ... Treasury Bills - Types, Features and Advantages of Government Yield Rate on Treasury Bills. The percentage of yield generated from a treasury bill can be calculated through the following formula – Y = (100-P)/P x 365/D x 100. Where Y = Return per cent. P = Discounted price at which a security is purchased, and. D = Tenure of a bill. Let us consider a treasury bills example for better understanding. If ... Bank Discount Rate Definition - Investopedia To simplify calculations when determining the bank discount rate, a 360-day year is often used. 360/270 = 1.33 Finally, multiply both figures calculated above together. 3% x 1.33 = 3.99% The...

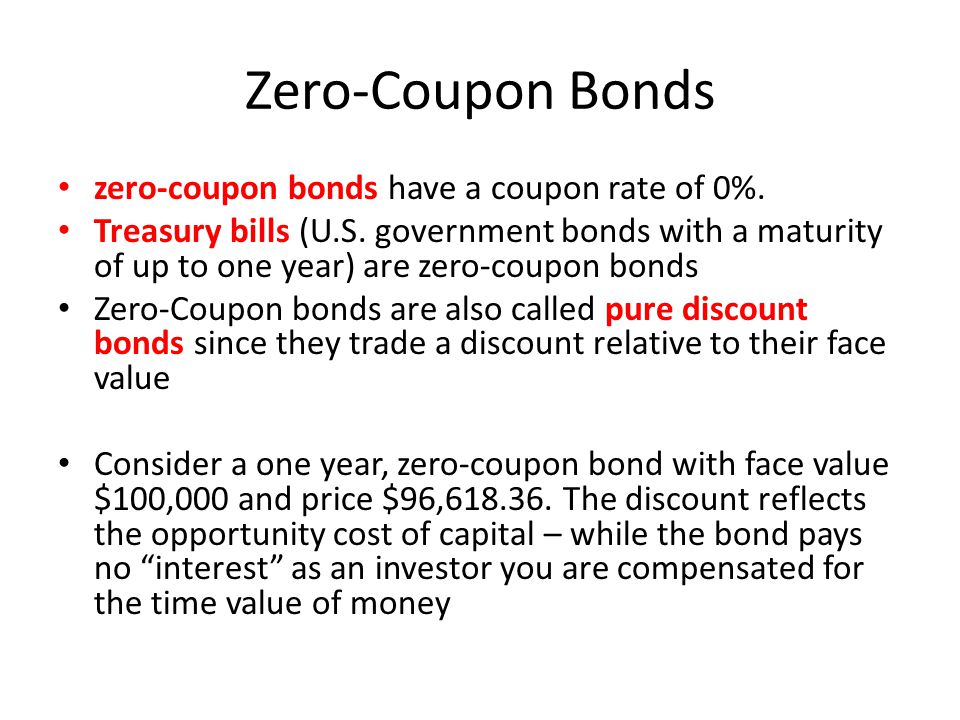

US Treasury Bonds - Fidelity The coupon rate is fixed at the time of issuance and is paid every six months. Other Treasury securities, such as Treasury bills (which have maturities of one year or less) or zero-coupon bonds, do not pay a regular coupon. Instead, they are sold at a discount to their face (or par) value; investors receive the full face value at maturity. What Is a Treasury Note? How Treasury Notes Work for Beginners Treasury bills have maturities of two, three, five, seven, and ten years. Treasury bills, notes, and bonds, are all forms of debt commitments that the United States Treasury sells. ... Treasuries pay interest in the form of coupons. The coupon rate is set before the bond gets issued and is charged every six months. What Are Treasury Yields ... United States Treasury security - Wikipedia Treasury bills (T-bills) are zero-coupon bonds that mature in one year or less. They are bought at a discount of the par value and, instead of paying a coupon interest, are eventually redeemed at that par value to create a positive yield to maturity.. Regular T-bills are commonly issued with maturity dates of 4, 8, 13, 17, 26 and 52 weeks, each of these approximating a different … Treasury Bills (T-Bills) - Meaning, Examples, Calculations - WallStreetMojo For example, The US Federal Treasury Department issued 52week T-Bills at a discounted rate of $97 per bill at face value of $100. An investor purchases 10 T-Bills at a competitive bid price of $97 per bill and invests a total of $970. After 52 weeks, the T bills matured.

Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia The Vanguard Extended Duration Treasury ETF ( EDV) went up more than 55% in 2008 because of Fed interest rate cuts during the financial crisis. 5 The PIMCO 25+ Year Zero Coupon U.S....

Treasury Notes — TreasuryDirect Interest rate: The rate is fixed at auction. It doesn't change over the life of the note. It is never less than 0.125%. See Results of recent note auctions. Interest paid: Every six months until maturity: Minimum purchase: $100: In increments of: $100: Maximum purchase: $10 million (non-competitive bid) 35% of offering amount (competitive bid)

Treasury Bonds | CBK Zero coupon bonds are similar to Treasury bills, in that they are sold at a discount and do not have interest payments. They are also typically issued for a short period of time. ... If the prospectus says that the coupon rate is market determined, you can select either the Interest/Competitive Rate or the Non-Competitive/Average Rate.

Should You Buy Treasuries? - Forbes The current rate on a U.S. two year Treasury is 3.05%.¹ In comparison, Nerdwallet reports the national average rate on a high-yield savings account is .70%. (Note: both figures are...

Treasury's Certified Interest Rates — TreasuryDirect About Treasury Marketable Securities Treasury Bills Treasury Bonds Treasury Notes TIPS Floating ... Quarterly Interest Rate Certification Semi-Annual Interest Rate Certification Annual Interest Rate Certification Continued Treasury Zero Coupon Spot Rates Average Interest Rates on U.S. Treasury Securities UTF ... Treasury's Certified Interest ...

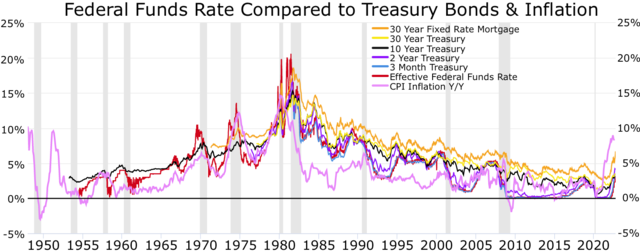

Investing in Treasury Bills: The Safest Investment in 2022? Jul 14, 2022 · Investing in treasury bonds can be a great way to diversify your portfolio and protect your money from market volatility. With the Fed increasing interest rates to combat inflation, investors of U.S Treasury bills (T-bills), Treasury notes (T-notes), and Treasury bonds (T-bonds) are seeing diminished yields, down from the previous 11-year high.

How To Invest in Treasury Bills - Investment Firms Treasury bills are sold at a discount rate, discounted from the face value of the security. For example, if the face value of a T-bill is $100,000 and is being sold at a discount rate of 1.5%; you would purchase the security for $98,500 and be paid $100,000 at the end of the bill's maturity. This implies you buy T-bills for a lower price than ...

How Are Treasury Bill Interest Rates Determined? - Investopedia For example, suppose an investor purchases a 52-week T-bill with a face value of $1,000. The investor paid $975 upfront. The discount spread is $25. After the investor receives the $1,000 at the...

Treasury Coupon Issues | U.S. Department of the Treasury Nominal TNC Data TNC Treasury Yield Curve Spot Rates, Monthly Average: 1976-1977TNC Treasury Yield Curve Spot Rates, Monthly Average: 1978-1982TNC Treasury Yield Curve Spot Rates, Monthly Average: 1983-1987TNC Treasury Yield Curve Spot Rates, Monthly Average: 1988-1992TNC Treasury Yield Curve Spot Rates, Monthly Average: 1993-1997TNC Treasury Yield Curve Spot Rates, Monthly Average: 1998 ...

Treasury Bills Statistics - Monetary Authority of Singapore SGS T-bill Yield Curve. 6 12 Tenor (Months) 2.870 2.875 2.880 2.885 2.890 Yield (%) Latest Yield. Previous Week.

Interest Rate Statistics | U.S. Department of the Treasury To estimate a 30-year rate during that time frame, this series includes the Treasury 20-year Constant Maturity rate and an "adjustment factor," which may be added to the 20-year rate to estimate a 30-year rate during the period of time in which Treasury did not issue the 30-year bonds. Detailed information is provided with the data

HM Treasury - GOV.UK HM Treasury Press Office. 020 7270 5238. Make an FOI request. Read about the Freedom of Information (FOI) Act and how to make a request.

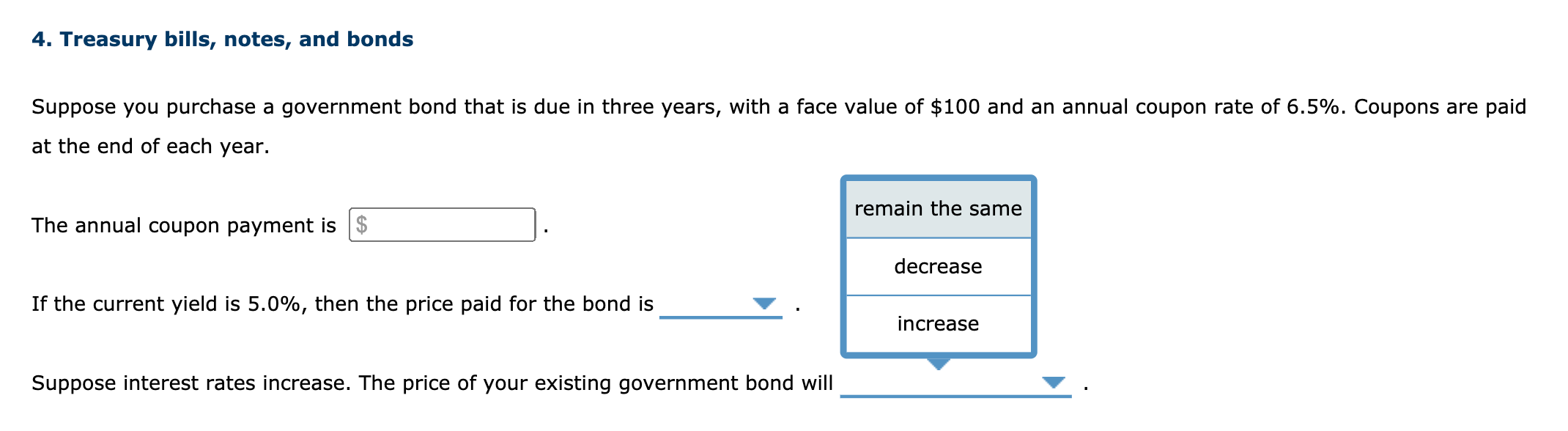

Coupon Rate Definition - Investopedia The coupon rate, or coupon payment, is the nominal yield the bond is stated to pay on its issue date. This yield changes as the value of the bond changes, thus giving the bond's yield to...

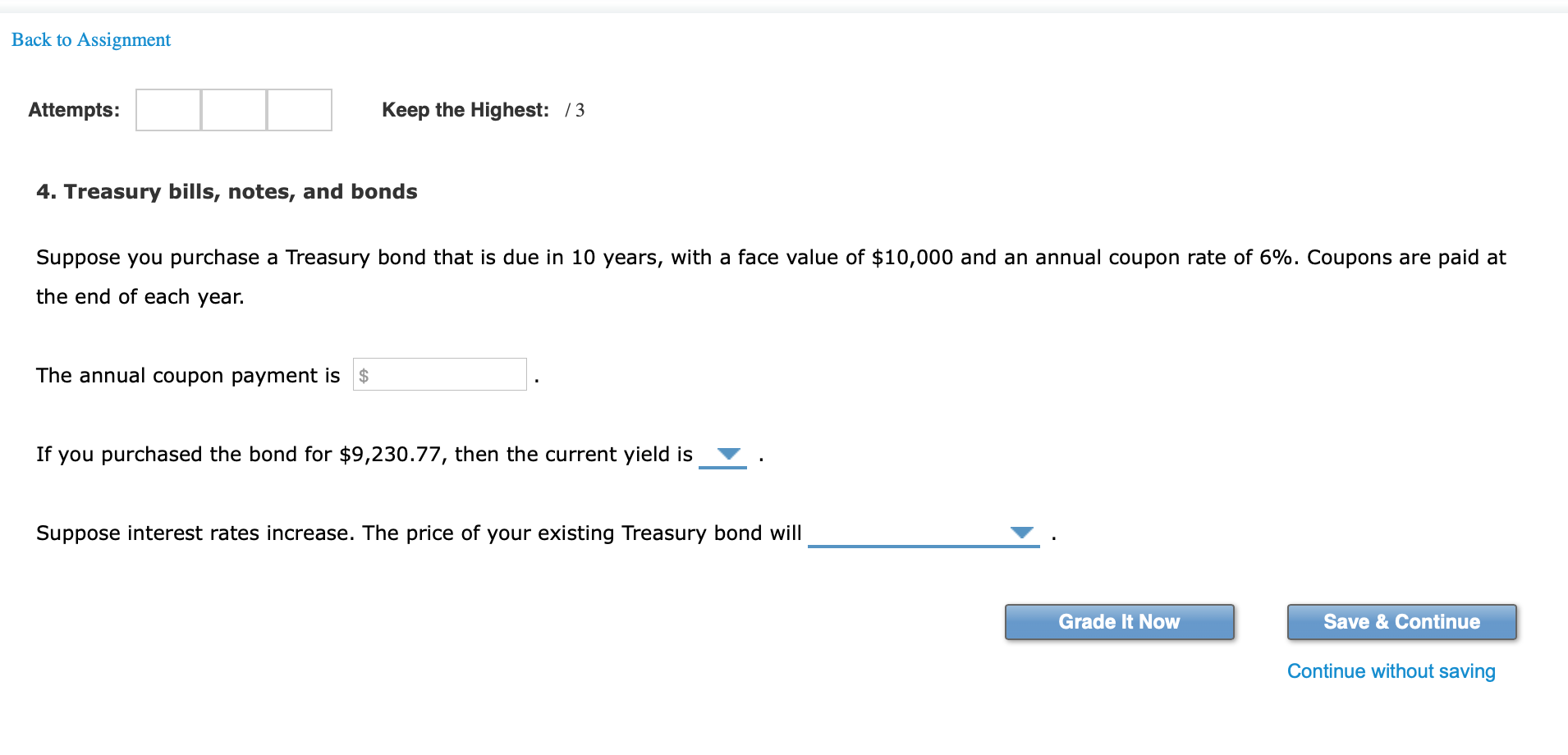

How Is the Interest Rate on a Treasury Bond Determined? - Investopedia Aug 29, 2022 · This is known as the coupon rate. For example, a $10,000 T-bond with a 5% coupon will pay out $500 annually, regardless of what price the bond is trading for in the market. Factors Affecting ...

What Are Treasury Bills (T-Bills) and How Do They Work? - Investopedia As stated earlier, the Treasury Department auctions new T-bills throughout the year. On March 28, 2019, the Treasury issued a 52-week T-bill at a discounted price of $97.613778 to a $100...

Coupon Equivalent Rate (CER) Definition - Investopedia Coupon Equivalent Rate - CER: A alternative calculation of coupon rate used to compare zero-coupon and coupon fixed-income securities. Formula:

:max_bytes(150000):strip_icc()/71080438-5bfc38c146e0fb0026052092.jpg)

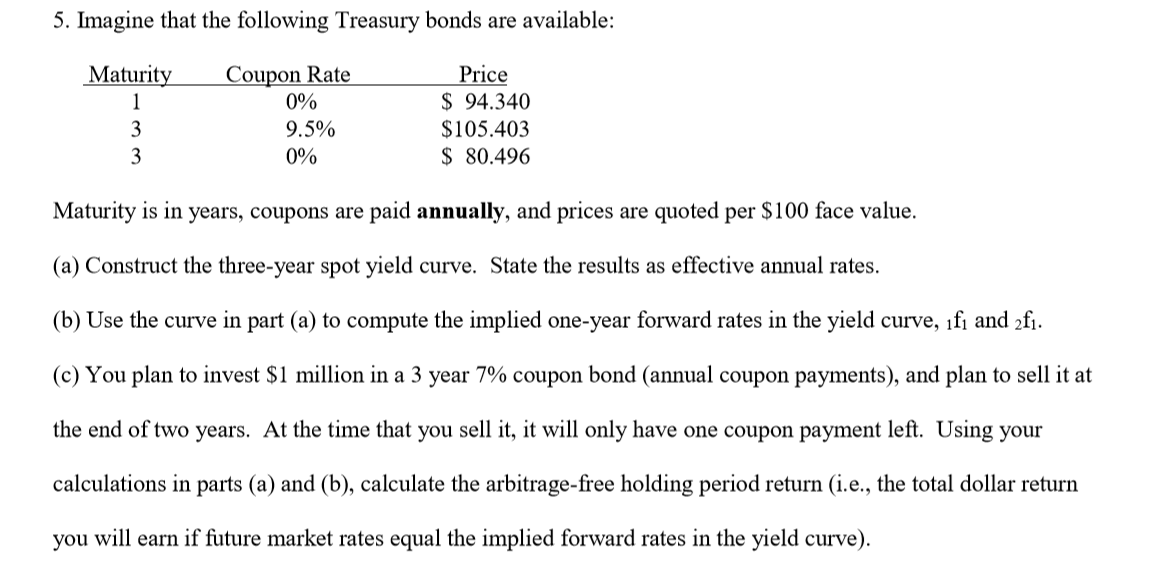

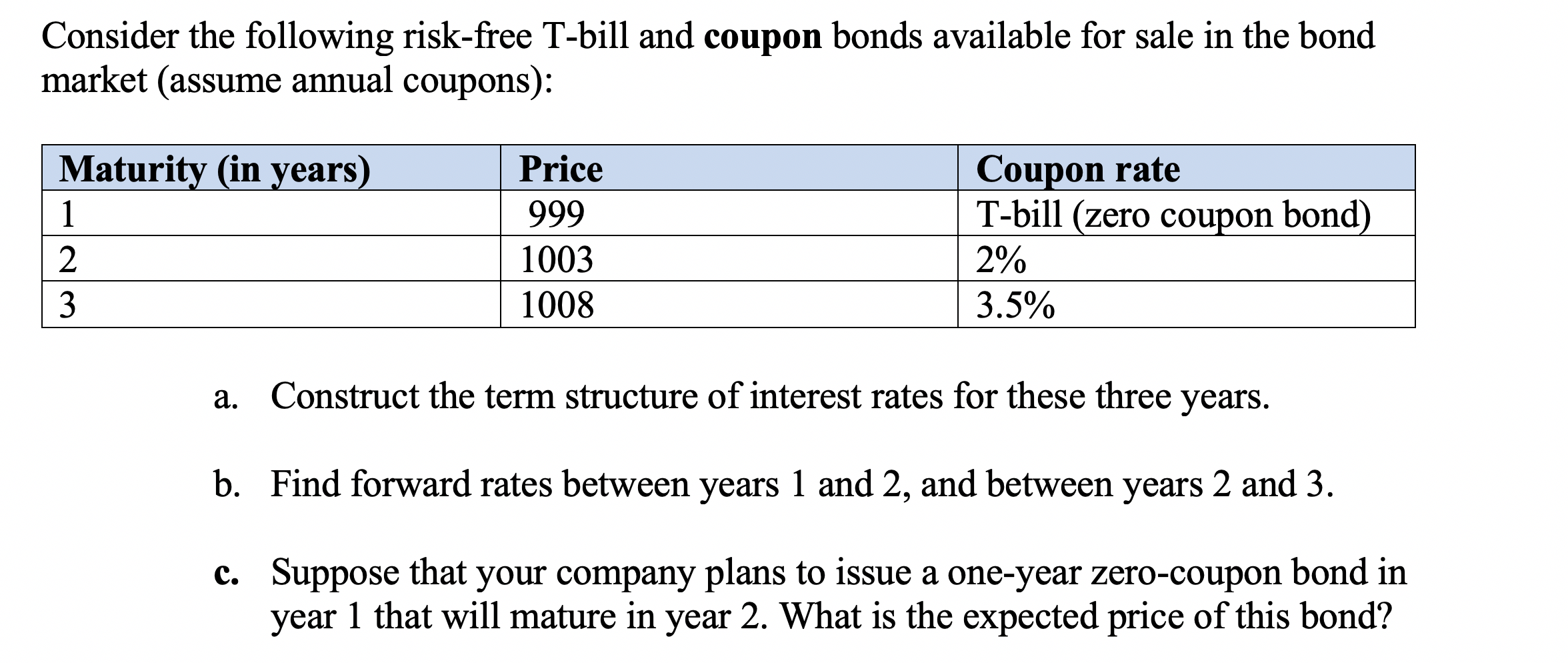

![1. [20 points] You observe the following Treasury | Chegg.com](https://media.cheggcdn.com/media/e27/e270d5a8-78a8-4494-b4e5-34ea83f2212f/php46N91z.png)

:max_bytes(150000):strip_icc()/shutterstock_164681615-5bfc2b55c9e77c0026305abc.jpg)

Post a Comment for "38 treasury bills coupon rate"